Executive Summary

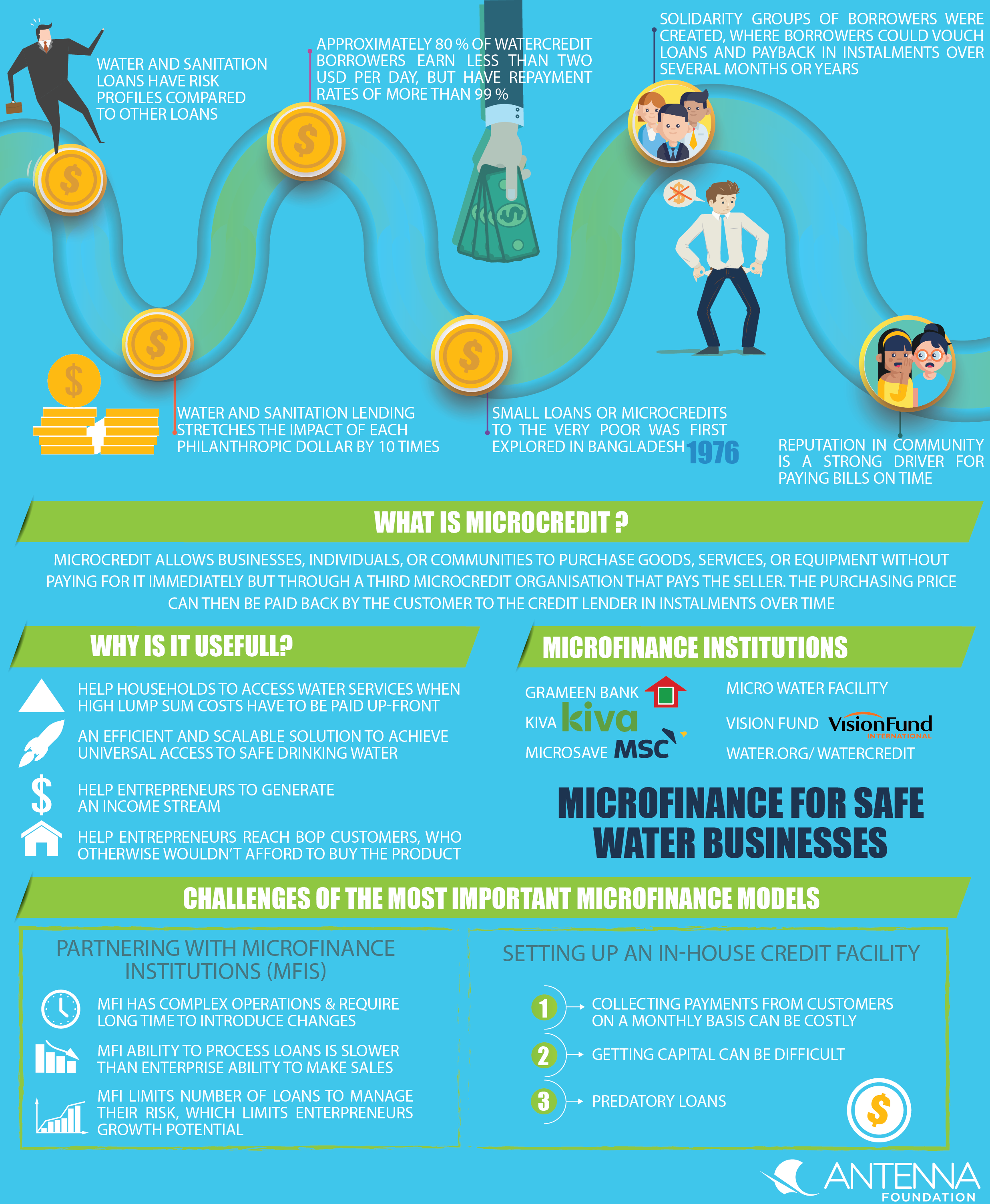

Microfinance also known as microcredits allows businesses, individuals or communities to purchase goods, services, or equipment without paying for it immediately but through a third microcredit organisation that pays the seller. The purchasing price can then be paid back by the customer to the credit lender in instalments over time (WSP, 2015a).

Key facts about microfinance in the safe water sector are:

- Household water and sanitation lending stretches the impact of each philanthropic dollar invested by 10 times.

- Water and sanitation loans have risk profiles comparable to other loans.

- Approximately 80 percent of WaterCredit borrowers earn less than USD 2 per day, but have repayment rates of more than 99 percent (WSP, 2015b).

This factsheet provides the reader with insights on microfinance mechanisms and instruments, and shows how collaborations with microfinance institutions can look like.

The case study of Hydrologic in Cambodia provides hands on insights of how the high upfront investment hurdle for a ceramic water filter has been mitigated by introducing microcredits.

Subscribe here to the new Sanitation and Water Entrepreneurship Pact (SWEP) newsletter. SWEP is a network of organizations joining hands to help entrepreneurs design and develop lasting water and sanitation businesses.

What is microfinance concretely?

The idea of microfinance, small loans or microcredits to the very poor was first explored in Bangladesh in 1976, when the Grameen Bank was created. For individual borrowers who did not have access to capital, solidarity groups of borrowers were created. In these groups borrowers could vouch for each other’s loans and pay the loans back in instalments over several months or years. Peer pressure increased repayments of the loans because the borrowers all knew each other and did not wanted to be the one among their friends who was not able to pay. This resulted in a very low rate of default on solidarity loans and repayment rates greater than 90% (NWP/IRC, 2007). The peer pressure within communities to repay the loan in instalments was also mentioned as one of the reasons for the low default rate in the case of the ceramic filter company Hydrologic. The reputation in the community is mentioned as a strong driver for paying bills on time (especially when it is a ‘group loan’ for several members of the community like with Hydrologic).

Why is microfinance useful?

People living on only few dollars per day have difficulties to make up-front investments for more expensive household water treatment systems (HWTS), filters for example. Microfinance (microcredit mechanisms) can:

- Help households to access water services when high lump sum costs have to be paid up-front, by splitting the costs into smaller tranches.

- Be an efficient and scalable solution to attract large amounts of capital that are needed to achieve universal access to safe drinking water by 2030.

- Help entrepreneurs to generate an income stream.

- Help entrepreneurs to penetrate the market. It can help entrepreneurs to reach BoP customers, who otherwise wouldn’t afford to buy the product.

For whom is microfinance interesting/useful?

Microfinance can be useful for product driven businesses, which sell products with relatively high up-front costs, such as Hydrologic in Cambodia. An in-house credit facility or partnership with a micro finance institution can help customers to purchase the product and pay in instalments. Microfinance is less interesting for service-driven companies, such as Spring Health in India. These type of companies charge relatively low fees on a daily or monthly basis, so customers don’t face the barrier of paying a high up-front cost they can’t afford.

How can microfinance be implemented in the safe water sector?

In the safe water sector, microfinance can be used to spread the payment for a HWTS product over several months. For instance a customer who buys a Tunsai water filter (see figure below) from Hydrologic for USD 36 can pay an instalment of USD 6 over 6 months with an interest rate of 2.8%.

There are various microfinance models in the safe water sector, the most important ones (from the Safe Water Program Phase II) are presented subsequently:

1. Partnering with microfinance institutions (MFIs)

Example of Hydrologic’s partnership with VisionFund

Hydrologic has a partnership with VisionFund to organise its microcredits. VisionFund offers loans to Hydrologic’s customers and handles the collection of payments and administration. The microfinance institution (MFI) collaboration has been very fruitful: 53,000 filter loans worth USD 1.9 million have been sold with over 99% repayment rate (HYDROLOGIC, 2015).

The MFI’s experience with loan collection helped Hydrologic but it also experienced limitations with this model:

- Large MFI organizations with complex operations require long lead times and perseverance to introduce changes.

- The MFI’s ability to process loans is slower than the Hydrologic’s ability to make sales, leading to lost sales.

- At times, the MFI limits the number of filter loans issued each month to manage their risk, which limits Hydrologic’s growth potential. (See case study for more details).

2. Setting up an in-house credit facility

Example of Hydrologic’s in-house credit facility

Hydrologic has set up an in-house credit facility with iDE after collaborating with VisionFund. The newly created in-house facility offers loans and instalment plans for products promoted by iDE Cambodia, such as Tunsai/Super Tunsai ceramic water filters. The credit capital used comes from KIVA, an international microfinance non-profit organisation.

The in-house credit facility strategy can be interesting for enterprises with strong connections to international organisations such as iDE, but less feasible for enterprises without these connections (see the below case study on Hydrologic for further details).

Challenges for safe water microfinance initiatives include:

- Collecting payments from customers on a monthly basis can be costly.

- Getting capital can be difficult.

- In some African countries, microfinance institutions offer extremely high interest or high penalty loans, also known as ‘predatory loans’ as they can put borrowers in a life of debt.

There are a number of international organisations that specifically support microfinance solutions and tools for the water and sanitation sector, such as the organisation Water.org with its Water Credit Program. Water.org has provided USD 11.3 million in subsidies to financial institutions and NGO partners worldwide, which in turn have disbursed over USD 460 million in loans reaching over 7 million people.

Microfinance institutions that a safe water enterprise could collaborate with are listed below:

- Grameen Bank: Providing microcredits and micro saving solutions

- KIVA: Online micro lending platform to develop microcredits

- MicroSave: Market-led solutions for financial services

- Micro Water Facility: Microfinance broker for water entrepreneurs to link with financial institutions for small loans

- Vision Fund: Microcredit lender that is active in over 30 countries in the Global South

- Water.org/ WaterCredit: Organisation that provides microcredits for water and sanitation sector

For more information about microfinance in the water and sanitation sector, have a look at these online Toolkits:

- WASH Microfinance Toolkits by Water.org/MicroSave

- Commercialisation Toolkit (Finance and sales chapters)

- IDinsight: Social impact investment, measuring and solutions platform

Hydrologic: Infiltrating the Market – Evolution of a Social Enterprise

Hydrologic has produced an extended case study documenting its 14 year evolution from a donor-funded NGO project to a sustainable social enterprise.

HYDROLOGIC (2015): Hydrologic: Infiltrating the Market – Evolution of a Social Enterprise. URL [Accessed: 31.05.2018]Microfinance for Water, Sanitation and Hygiene: an Introduction

Commercialisation Toolkit: Finance and Sales chapters

Financing Water and Sanitation for the Poor: WSP learning note. Washington, DC: World Bank

Financing Sanitation for the Poor

Helping a New Breed of Private Water Operators Access Infrastructure Finance: Microfinance for Community Water Schemes in Kenya

This paper showcases innovative microfinance approaches to bring affordable safe water to the poor. In Kenya, a collaborative program is bringing together community-based organizations and micro-lenders to provide better water services to poor people and generates lessons for similar initiatives.

MEHTA, M. VIRIEE, K NJOROGE, S. (2007): Helping a New Breed of Private Water Operators Access Infrastructure Finance: Microfinance for Community Water Schemes in Kenya. (= 25 ). Washington: World Bank URL [Accessed: 18.04.2018] PDFSanitation and Water for All : How Can the Financing Gap Be Filled?

This discussion paper provides a framework for country-level discussion, setting out key considerations for countries as they undertake financial planning for efforts to meet the SDGs. This paper covers the following aspects: (i) Estimating the costs and benefits associated with the SDG targets for WASH; (ii) Using existing financial resources more effectively; (iii) Accessing new resources; and (iv) Taking action to close the SDG financing gap.

WORLD BANK UNICEF (2017): Sanitation and Water for All : How Can the Financing Gap Be Filled?. Washington: World Bank URL [Accessed: 18.04.2018] PDFSpring Health - What We Do

Spring Health is a water kiosk enterprise active in rural Odisha, India. At the doorstep via home delivery and at pick up points people purchase safe water in jerry cans. For more information please visit the homepage.

SPRING HEALTH (2017): Spring Health - What We Do. URL [Accessed: 10.04.2018]iDE NGO

Safe Water Program - Antenna Foundation

The Safe Water Program Phase II is a 3-year project funded by the Swiss Agency for Development and Cooperation and Aqua for All, with the aim to increase access to safe water at global scale and to contribute to the human right to water through integration of the business models in the national regulation. Supported and documented businesses are ECCA and MinErgy in Nepal, PakoSwiss in Pakistan, Spring Health and TARA in India, Tinkisso in Guinea, and Hydrologic in Cambodia.

https://www.antenna.ch/en/activities/water-hygiene/scaling-up-safe-water/ [Accessed: 31.05.2018]Scaling up safe water

Vision Fund International

Microcredit lender that is active in over 30 countries in the Global South

http://www.visionfund.org/ [Accessed: 18.04.2018]