Executive Summary

An investor pitch is a presentation of your business model that shows the potential for scale in front of potential investors with the aim to raise money for your venture.

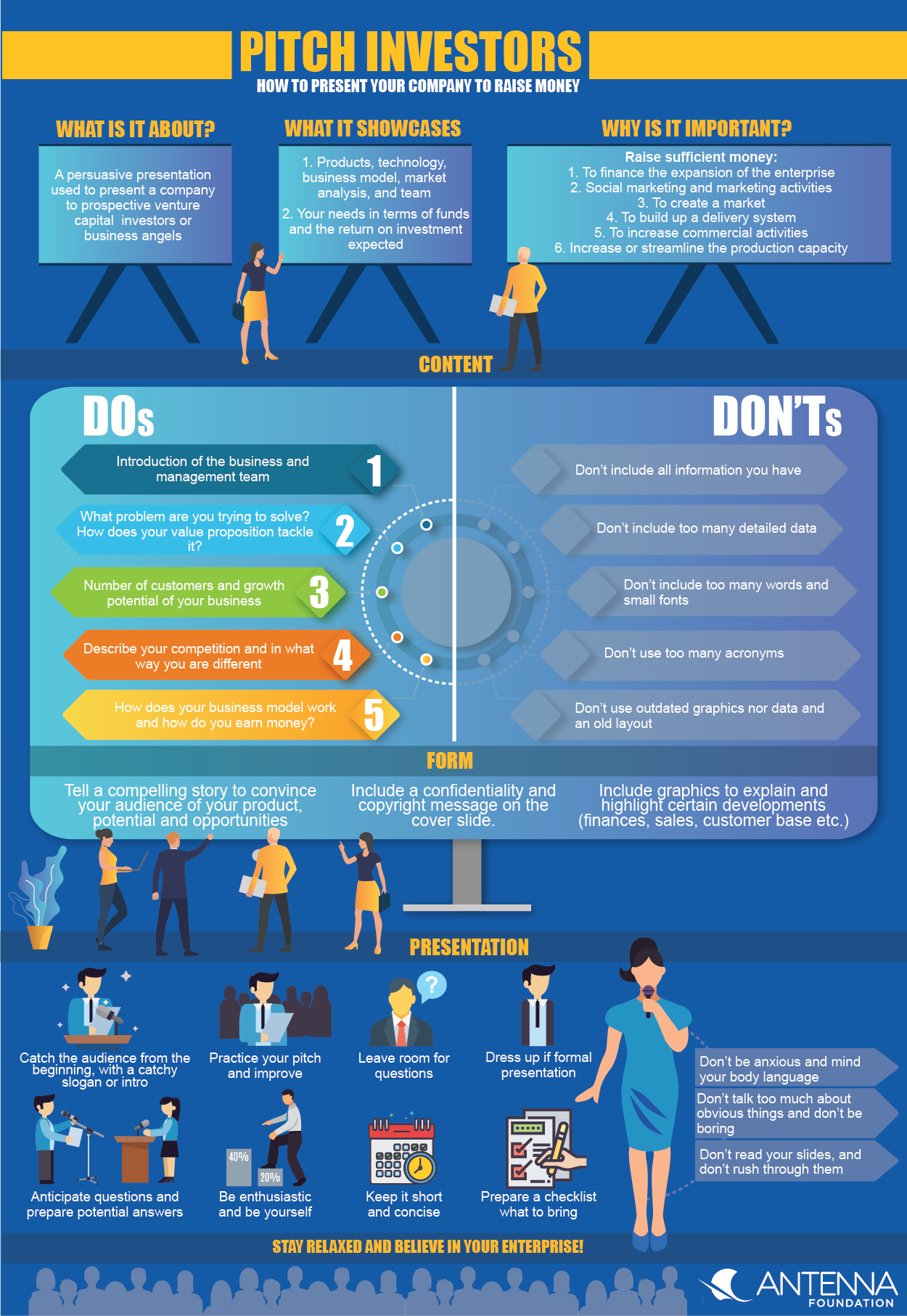

This factsheet about pitching investors provides insights on what aspects are key in transforming your company’s story and objectives to a fascinating presentation for investors. Aspects of how your pitch deck (presentation) and presentation style could look like are also discussed and dos and don’ts presented.

Real business pitch decks and videos of investor’s pitches do provide insights and inspiration of how an outstanding and individual pitch can be developed.

What is an investor pitch about?

An investor pitch is a persuasive presentation used to present a company to prospective venture capital (see venture capital box) investors or business angels. Important for an investor pitch is to tell the audience a compelling story about your company and its potential to grow and make profits in the future. A successful investor pitch can be very individual but shall raise interest in your enterprise and convince investors of missing a great opportunity if they do not invest (ILGAZ, 2015).

A pitch presentation is usually based on PowerPoint slides, the so-called deck or pitch deck that provides your audience an overview of your business in an attractive and concise manner. It is recommended to bring also a short summary document (or your business plan) along that you could leave behind to provide additional information if needed. The pitch is meant to showcase products, technology, business model, market analysis as well as the team. But it should also present your needs in terms of requested funds and the return on investment (ROI) that could be expected. Keep in mind that even impact investors who are looking for meaningful activities are also looking for financial profits. Some investors are only interested in numbers, but (social) impact investors would like to know also what the enterprise achieves in terms of (social) impact for direct and indirect customers and the enterprises involved in the supply chain (GIIN, 2018).

For inspiration, watch TV programs where start-ups pitch in front of investors and have to answer particular questions on their business model in order to potentially receive an offer for investment (Dragon’s Den, shark tank).

| BOX: Venture Capital Venture capital is a form of financing that is provided to start-up companies or mature businesses by investors; unlike bank loans that need total security, venture capital is especially invested in higher risk businesses and enterprises that are believed to have a long-term growth potential. Usually, venture capital poses a higher risk for investors, but also a high return potential if the company is able to scale and increase level of profits. Investment banks, business angels and other venture capital institutions generally invest venture capital. In order to receive venture capital an enterprise has to undergo a thorough due diligence processes to assess eligibility. Such a process includes an analysis of the business model, the product or service offering and the managerial ability of the company. Within this process a company looking for funds has to pitch its enterprise model in front of investors. Have investors agreed to provide funding to the venture, the investor will usually take an active role in the company, be it in form of shares, via managerial support or access to the network of the company. Venture capitalists are interested in having some rewards in the future and not immediately. More information about venture capital can be found on:

|

Why is a high-quality investor pitch important?

Preparing for scale imposes different challenges for a company. One of the most important factors for scaling up a safe water business is to raise sufficient money to finance the expansion of the enterprise. Start-up companies are usually confronted with high financial needs during the take-off phase. Such investments are for example needed for social marketing and marketing activities in order to raise awareness among people, to create a market, to build up a delivery systems, to increase commercial activities or to increase or streamline the production capacity. This phase of crossing the “valley of death” (see Figure bellow) until the company’s benefits reach the point that permits steady payback of investments may be long. Entrepreneurs must therefore take opportunities to raise capital from different channels (see also factsheet on blended finance for more information) and a good presentation of your business can be helpful to attract investments.

For whom is the investor pitch factsheet useful?

To have a professional investor pitch is a necessity for a safe water enterprise in preparing for scale. The factsheet is also interesting for NGOs that are transforming towards market based approaches and private sector initiatives. On the contrary can also investors learn more about pitch processes.

How can you develop your own investors pitch?

To hold a successful investor pitch you need to develop a concrete presentation telling your unique story, bring the key experiences/information from all the departments of your company (from direct sales to accounting, from supply to the installation team) on the table. Besides collecting all those data and/or experiences, it is important to become a great presenter: this means to think about the messages that may make a potential investor interested and understand your business. Even if you don’t master English or the language of the investors very well, you should convey the energy and the main driving force that brought you to create this company.

Bringing the right messages across is not an easy task: an entrepreneur is usually too close to his own daily business to make an investor understand the key aspects and an overview of the business, its difficulties and its opportunities. It may, therefore, be advisable to look for local support: there might be trainings available at your local chamber of commerce or other institutions where you could get professional advices on your pitch. And even if this support is not available, it will help to do a rehearsal with an independent person to check if the messages are understood and hone the pitch and your presentation style accordingly (PATEL, 2015).

A pitch, also called elevator pitch can be used not only to attract investors but also to find partners, possible associates or costumers (how to create a pitch or (elevator pitch) and common mistakes).

Pitch deck: Dos and don’ts (DOUGLAS, 2017; HARROCH, 2017)

Dos:

Content

- Aspects to be included: Introduction of the business and management team (showing its capability), what problem are you trying to solve?, and how does your value proposition / solution tackle these problems?, describe the advantages of your solution, and the product or service as such; provide information about the numbers of customers and growth potential of your business case. If possible, give proof that the business model works, sketch out the market size (at least a prediction), but describe also the competition and in what way you are different, how your business model works and how you earn money. Using the business model canvas (see factsheet on business model development for more information) will help to structure these aspects in a coherent way.

- Specify the amount of money you would like to raise and what conditions you foresee for the investor: Address the timeframe needed to get returns and describe what investors can expect to earn if they are investing (this is what most investors are actually interested in and expect you to address and answer). This reflects the so-called exit strategy describing when and how investors will get their money back. If you are a social enterprise, describe the financial projections and returns but also the potential social and environmental impact that your business may create.

- Make your product tangible, e.g. bring a prototype with you or provide the investors with a sample of the product if applicable.

Form

- Do tell a compelling story to convince your audience of your product, service, and company’s potential and market opportunities ahead.

- Include graphics to explain and highlight certain developments (finances, sales, customer base etc.)

- Include a confidentiality and copyright message on the cover slide. For example: Confidential and Proprietary. Copyright © by [Your company’s name]. All Rights Reserved.

Don’ts:

- Don’t include all information you have, but be concise and precise with the information provided. If investors do have questions, they will ask you at the end of the presentation (details can be provided in a follow-up email and/or by bringing along detailed information about finances etc. as hard-copy).

- Don’t include too many detailed data and statistics, it can be confusing for people and miss the key message you want to convey.

- Don’t include slides with too many words and small fonts that people cannot read.

- Don’t use too many specific wordings and acronyms as investors might not understand it.

- Don’t use outdated graphics nor data and an old layout.

Presentation: Dos and don’ts (DOUGLAS, 2017):

Dos:

- Do catch the audience from the beginning, for example with a catchy slogan or intro.

- Be enthusiastic, be yourself. You have all information in your hands.

- Keep it short and concise (15-20 slides) and keep to the time-limit given for your presentation

- Take the time given and if possible use less time than allowed, leaving room for questions and comments.

- Anticipate questions and prepare potential answers.

- Do practice your pitch and improve content and presentation style ongoing.

- Practice your pitch in front of a friend you can trust for rehearsal and who can – and will!!! – criticise you. And practice again and again and again.

- Dress up if the audience requires a more formal presentation.

- If helpful prepare a checklist what to bring along with you in order not to forget anything.

- Be well-prepared and double check if you have everything ready for the presentation in advance.

- With all this, stay relaxed and be confident with your enterprise.

Don’ts:

- Don’t be anxious and do mind your body language (practice in front of a mirror, if needed).

- Don’t talk too much about obvious things.

- Don’t be boring.

- Don’t read your slides, but speak freely and tell a story.

- Don’t rush through the slides.

In order to attract money from different investors, Spring Health developed its specific pitch deck to present its business model and opportunities for investment to investors.

Please find the example here to learn very practically how it can be done Source: SPRING HEALTH, 2013:

Subscribe here to the new Sanitation and Water Entrepreneurship Pact (SWEP) newsletter. SWEP is a network of organizations joining hands to help entrepreneurs design and develop lasting water and sanitation businesses.

The Do’s and Don'ts of Pitching to Investors

Impact Investing

How to Create a Great Investor Pitch Deck for Startups Seeking Financing

The 5 Best Pitch Tactics I Heard as an Angel Investor

Six Myths About Venture Capitalists

An Empirical Analysis of the Valley of Death: Large-Scale R&D Project Performance in Japanese Diversified Company

13 Tips on How to Deliver a Pitch Investors Simply Can't Turn Down

What is a pitch deck?

Listen as Start-ups Pitch investors for funding

The Pitch provides podcasts about business pitches and background information for entrepreneurs. Each episode takes you behind closed doors to the critical moment when aspiring entrepreneurs put it all on the line. The Pitch delivers on the high-stakes promise of a live pitch without shying away from the nitty gritty details of what happens after everyone shakes hands and walks out of the room.

THE PITCH (EDITOR) Listen as Start-ups Pitch investors for funding. URL [Accessed: 20.04.2018]Business Pitch, Elevator Pitch, and the LivePlan Pitch: What’s the Difference?

This article discusses different ways of how to present/pitch your business depending on the audience you want to reach.

BARRY, T. (20117): Business Pitch, Elevator Pitch, and the LivePlan Pitch: What’s the Difference?. URL [Accessed: 20.04.2018]Dragons' Den Channel

Dragon’s Den TV programme where start-ups pitch in front of investors and have to answer particular questions on their business model in order to potentially receive an offer for investment.

https://www.youtube.com/user/dragonsden [Accessed: 20.04.2018]Investopedia

Information on venture capital

Entrepreneur

Information on venture capital

Edupristine

Information on venture capital