Executive Summary

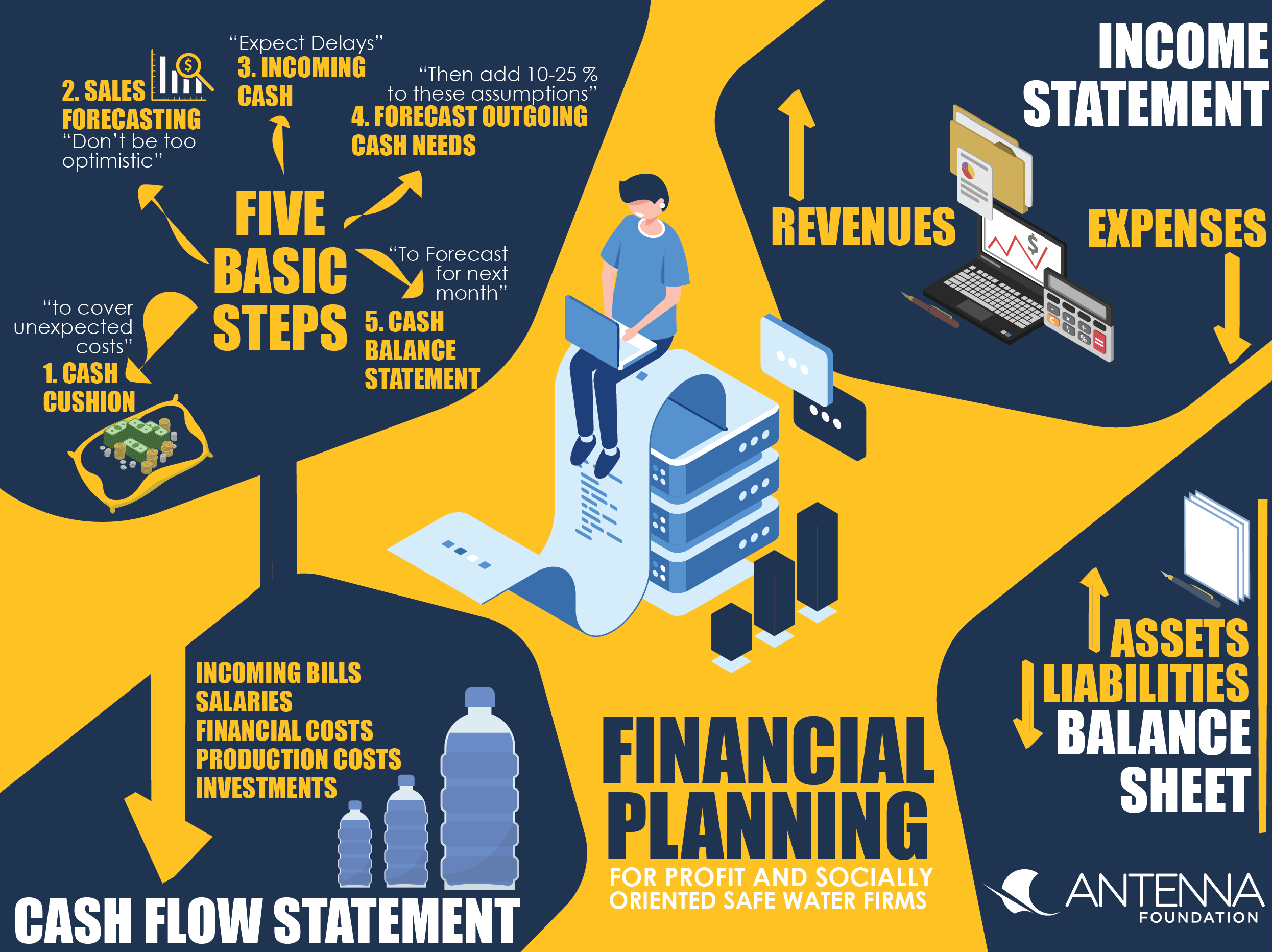

Financial planning is important for every safe water enterprise in order to start its activities and plan the financial needs of the company from a daily to an annual basis. The financial planning tool introduces three important financial statements, the balance sheet, income statement, and cash flow statement. With these methods a safe water enterprise should be able plan its budget and financial needs, read and interpret the financial statements and change strategy according to identified bottlenecks for its business roll-out strategy on a day-to-day basis.

What is financial planning about?

Financial planning assesses a company’s performance and refers to projection of income and expenses of a company and of financial and/or cash needs for funding growth in coherence with a company’s mission and vision (DELOITTE, 2014). To elaborate on the concept of financial planning three main financial statements (balance sheet, income statement, and cash flow statement) are introduced subsequently.

Subscribe here to the new Sanitation and Water Entrepreneurship Pact (SWEP) newsletter. SWEP is a network of organizations joining hands to help entrepreneurs design and develop lasting water and sanitation businesses.

Why is financial planning crucial?

A social enterprise may have profitability as its goal, or it may not: A company’s goal may be becoming financially sustainable so that sales revenues cover both standard business costs and the extra costs to pursue a social, environmental and/or cultural mission. To forecast the financial needs it is recommended for (social) safe water enterprises, to accurately and timely do financial planning. A clear accounting of the costs and profitability of enterprises is critical to demonstrate the value of a social enterprise in communities and to make a case for investment and support from government and private sector investors. For example, it can be easier to fundraise when a company can clearly describe the costs that occur in the future and that relate to your social/environmental mission. An additional advantage is that a financial plan allows you to improve your cost efficiency if you know the current costs of your operations and the profit and loss status of your business. (DEMONSTRATING VALUE, 2013; SCHMIDT, 2018).

For whom is financial planning interesting?

Financial planning is important for any profit and socially oriented safe water firm starting out their business and therefore must assess the financial resources required depending on profit and loss forecast. Financial planning is also relevant for existing businesses that need to assess the financial needs to pursue the company’s mission on a daily basis especially in terms of cash flow needs.

How can a company implement financial planning?

The three basic components of financial planning, the balance sheet, income statement, and cash flow statement are crucial for every safe water enterprise doing financial planning and are explained subsequently:

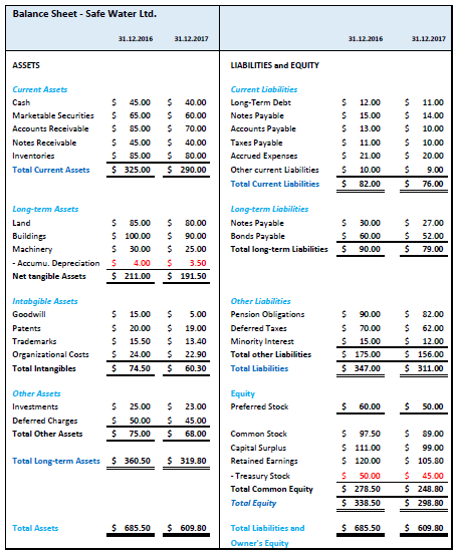

Balance sheet

A balance sheet is a statement of the financial position of a business, which states assets, liabilities, and owners' equity at a particular point in time. Subsequently an example of a fictive balance sheet is shown as per 31.12.2017.

A variety of tools to help budgeting and plan finances can be accessed online: simple explanations of budget planning and resource allocation.

Income statement or profit and loss statement

The income statement or also called profit and loss statement is a report for a business showing its profit or loss over a certain period of time by comparing income (e.g. of water sales or HWTS) and the expenses to produce and sell the product or service. It reflects the financial performance of an enterprise and is important for attracting additional investments (JIANU, JIANU & GUSATU, 2012).

• Simple explanations of financial planning to elaborate on costs associated to the income and expense factors for profit and loss statement are shown subsequently:

To learn more about acquiring investments and how to present your company to investors see also the factsheet on how to pitch investors.

Cash flow statement

With the cash flow statement an enterprise identifies the cash needs (liquidity) and solvency for its daily operations in order to pay incoming bills, salaries, financial costs as well as production costs and investments. Such measures are crucial to keep your safe water business running.

Templates to do a cash flow statement for cash flow planning can be found online or even on Microsoft Excel. There are five basic steps to prepare your company for an adequate cash flow (adapted from SKELTON, 2015):

- Determine an adequate minimum cash balance. How big should your enterprise’s cash cushion be to cover unexpected costs that might occur in your day to day business activities? It is recommended to prepare measures for eventualities where additional money is needed for special occurrences.

- Sales forecasting: Don’t be too optimistic in forecasting your company’s HWTS and water sales – accordingly you are able to make sure that you do not expect too high incoming cash flows.

- Incoming cash from sales: There might be delays in collecting money as customers pay by installments or at the end of the month for example.

- Forecast outgoing cash needs: Forecast cash required by month – start-ups are recommended to add 10-25 percent on top of these assumptions in order to prevent business from insolvency.

- Cash balance statement: Depending on your chosen monitoring cycle you could collect on a daily basis total cash on hand, balance of bank account, summary of the day’s cash disbursements and of accounts receivable. At the end of each month one could then summarize incoming and outgoing cash to come up with the exact cash flow that allows hands-on forecasting of cash needs for the upcoming month(s).

Liquidity planning offers additional information about managing a company’s cash flow.

With these baseline tools your company should be able to plan and manage current and future financial needs properly.

Financial Intelligence: A Guide for Social Enterprise

Integrated Performance Management – Plan.Budget.Forecast

Deloitte’s research into planning, budgeting and forecasting has analysed the survey responses of over 500 senior finance professionals and provides insights on how to efficiently plan and prioritise financial planning within a company.

HORTON, R., SEARLES, P. and STONE, K. Deloitte (2014): Integrated Performance Management – Plan.Budget.Forecast. URL [Accessed: 09.08.2018]Profit and Loss Account or Comprehensive Income Statement

Budget, Budgeting, and Variance Analysis - Definitions, Meaning Explained, Calculations, Budget Examples

Business Planning & Financial Statements Template Gallery

Financial Management

A New Financial Reporting Model for Social Enterprises -Treating philanthropic grants as revenue can hurt social enterprises’ performance

This article explains how treating philanthropic grants as revenue can hurt social enterprises’ performance and provides insights on how a social enterprise can improve its financial reporting leading to more efficient processes and higher impact.

LEDERHOS, M. (2016): A New Financial Reporting Model for Social Enterprises -Treating philanthropic grants as revenue can hurt social enterprises’ performance. URL [Accessed: 09.08.2018]Water Business Kit Kenya: A guide to starting your own water treatment and vending business

The IFC publications provides hands-on insights and checklists for developing a safe water business. The theoretical information is illustrated by examples and a case study in Kenya.

International Finance Cooperation (IFC) (2013): Water Business Kit Kenya: A guide to starting your own water treatment and vending business. Washington, D.C.: URL [Accessed: 09.08.2018]