Executive Summary

A project cannot be developed in isolation and without considering the market environment that it operates in. When developing your project you have to consider the current market size, its potential for growth, prices, costs, needs and expectations of your target groups, as well as any societal trends that could influence your project (directly or indirectly). It is also crucial to assess who your current and potential competitors are so that you can avoid them getting in the way of you reaching your customers. This factsheet will help you understand how to develop a market and competitor analysis which can increase the likelihood of your project success and long-term sustainability.

A business does not exist in isolation but instead works within a larger organism that keeps it alive: we call this organism the market. Many young professionals and entrepreneurs who have little or no experience of the market often make the mistake of targeting too much of a broad market instead of focusing on the market niche that will be most relevant to their product/service (SBA NO YEAR). Others don’t bother conducting a thorough competitor analysis, a necessary step for understanding what to expect when moving the project into its implementation phase. We highly advice any entrepreneurs to conduct a thorough market and competitor analyses if they want to ensure overall project success. Let’s look into both of them:

Market Analysis

The first step is to analyse and describe the contexts and environments (markets) that your potential project aims to target. This will help you lay the foundation for analysing your potential target group/s and competitors, which should be done at a later stage.

The two most important elements to look into during this preliminary step are: market size (e.g. overall revenues generated in the sanitation market in a specific country)and market growth (e.g. 10% annual growth in overall revenues for the past five years). In addition, you should gather information on general fluctuation of prices, costs and returns in your target market/s. You should also identify current and future trends in the market such as advancing digitalisation of specific services and solutions as well as specific market trends like decentralisation of sanitation management or resource recovery in sanitation .

Market Segmentation, Targeting and Positioning

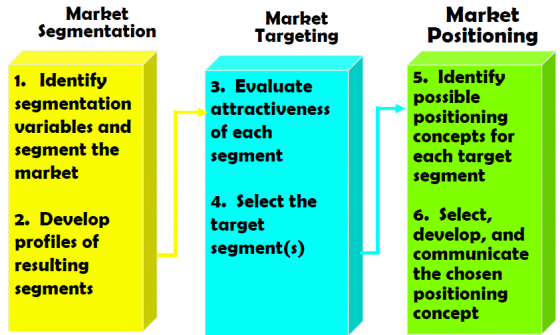

Once you understand your target market environment , you should find the right strategies for positioning yourself within that specific market. Since markets can be very big and overwhelming it is often difficult for new players to penetrate them and secure a place in them. We therefore recommend that you opt for more of a narrow approach, which can put you in a unique position within a niche market (KERR NO YEAR)(Figure 1).

To effectively tackle your desired market you have to identify and understand the contexts, realities, feelings, environments, needs, expectations, and fears of the people who operate in that market. For this to work, you need to cluster these people into specific groups or segments that correspond with what you want to offer and what your project wants to achieve in this specific market. Target groups segmentation is the process of dividing the market into smaller groups with respect to factors that influence the demand, the delivery, and success of your project, such as (SMALLBIZCONNECT NO YEAR):

- Geographic: Region, population density, climate etc.

- Demographic: Gender, age, income, education etc.

- Psychographic: Interests, opinions, attitudes etc.

- Behavioural: Readiness to buy, user status etc.

After you have segmented the people within your target market, you can start identifying the segments that you want to target (SMALLBIZCONNECT NO YEAR).

Finally, you can start designing and positioning your project’s offering and branding so that it occupies a distinctive place in your target market (SMALLBIZCONNECT NO YEAR). This step could be included in your overall marketing strategy.

Figure 1: Strategizing process: Segmentation (S), Targeting (T) and Positioning (P).

Competitors Analysis

Competitors are other individuals, projects, companies, institutes, or organisations that work in the water and/or climate sectors and solve the same problem for your target groups as your product/service. You can distinguish direct competitors, i.e. projects that offer the same or a comparable solution/service and indirect competitors, i.e. projects that satisfy the same need for your target group/s but through a different solution or service (SAAS NO YEAR). For example, if your project offers an innovative tool to drill boreholes for a specific target group to gain access to groundwater sources in an environmentally sustainable manner, your direct competitors are obviously other environmental friendly borehole drilling projects/initiatives. However, your target group’s need for access to water can also be satisfied by other projects that offer installation of innovative environmental friendly water tanks or rainwater harvesting devices. Such projects will then simply be your indirect competitors. In order to prepare for any eventuality, when conducting your competitors analysis you will want to include information on projects, start-ups, and/or initiatives that might be entering your targeted market in the coming months/year (KNOWLES, 2002).

After recognizing your competition, you need to start gathering and analysing data. How and why? Let’s find out.

Data Gathering and Analysis

Compiling data about your competitors will help you have a clearer picture of the market and will put you in a better position to compete. Finding information on the websites of your competitors’ organisation/project is a good first step to get to know them. You can also find information in annual reports, social media platforms, your networks, sectors’ newsletters, magazines and publications on individual or collective competitors, since they are good sources to get the most current and relevant information (CPSA NO YEAR). Conferences, seminars and physical and virtual events and webinars are forums that allows you to get into more direct interaction with relevant actors in the water and climate sectors (CPSA NO YEAR). In addition, target groups and partners of competitors might be willing to share information with you.

Some of the most important questions that you need to answer while analysing your collected data are:

- Who are your project’s direct competitors?

- Who are your project’s indirect competitors? What substitute solutions or services exist in your target market?

- What are their strengths and weaknesses?

- What are their ultimate goals? (e.g. achieving recognition, profit, raising awareness, … etc.)

- What are their prices?

- Why are people interested in them?

- How is their solution/service/project better than other options in the market?

- Where are they located?

- What are their value propositions?

- How is their quality?

- What is their reputation?

- What distinctive competencies and experiences do they have?

Now that you have done your homework and prepared a thorough analysis of your competitors, you are still missing one last crucial step: “Competitor Comparison”. Read the last part of this factsheet to learn more about it.

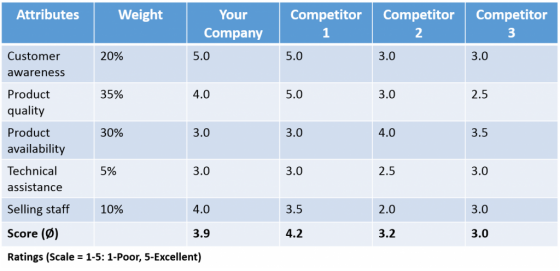

Competitor Comparison

Once you have gathered and analysed sufficient data about your competitors, you can start comparing your project with its competitors. Here, you can use what is widely known as “Key Competitive Factors (KCF)”. These KCFs are characteristics and factors that are specific to your target market. It is not only important to think about your own KCFs but also to be aware of your competitors KCFs. These factors help you understand and explain the relative success of your competitor in your target market. Examples for possible KCFs are:

- Reputation

- Cost per unit

- Experience

- Brand

- Relationships

- Staff skills

- Customer services

- Product quality

Figure 2: Competitor analysis table

If you are keen to practice the knowledge you gained in this factsheet and prepare a first version of your market and competitors analysis, go ahead and download our worksheet now.

Go to next topic!

3.8 Learn to manage your finances

How to Write a Market Analysis

Create your Business Plan

A guideline to create the market analysis section of a business plan by U.S. Small Business Administration (SBA).

SBA (n.y): Create your Business Plan. U.S. Small Business Administration (SBA) URL [Accessed: 30.10.2015]How to Write a Competitive Analysis

Competitive Analysis

A guideline on how to conduct a competitors analysis.

SAASNET (n.y): Competitive Analysis. Understanding Your Competition. State Association of Addiction Services (SAAS) URL [Accessed: 16.12.2015]How to Do a Market Analysis and Environmental-Trend Analysis

This presentation provides an introduction into market and environmental analyses.

HOLMS, A. (n.y): How to Do a Market Analysis and Environmental-Trend Analysis. UCSB Writing Program and College of Engineering URL [Accessed: 16.12.2015]http://www.wikihow.com/Write-a-Market-Analysis

A 12 step guide on how to write the market analysis section in your business plan.

How to Do an Industry and Competitive Analysis

An introductory presentation on industry and competitive analysis.

HOLMS, A. (n.y): How to Do an Industry and Competitive Analysis. UCSB Writing Program and College of Engineering URL [Accessed: 16.12.2015]Competitive Analysis

A guideline on how to conduct a competitors analysis.

SAASNET (n.y): Competitive Analysis. Understanding Your Competition. State Association of Addiction Services (SAAS) URL [Accessed: 16.12.2015]http://www.netmba.com

Webpage which gives a guideline on competitor analysis, including a framework by Michael E. Porter.

http://www.netmba.com

Webpage which gives a guideline on competitor analysis, including a framework by Michael E. Porter.