Context

Globally, water-related issues present one of the biggest challenges that need the attention of governments, civil society and private sector. More than 2 million people do not have access to safe drinking water and 4.5 billion people live without access to sanitation. With climate change becoming increasingly apparent, water scarcity is set to rise as well over the next years.

The private sector, particularly locally anchored small enterprises, have a critical role to play in addressing this challenge and achieving the Sustainable Development Goal 6. With their fresh and disruptive thinking, local entrepreneurs provide financially viable solutions and new impulses for the broader water nexus. Yet, access to the required early stage risk capital, particularly smaller ticket sizes ranging from 10-1000k USD, remains restricted.

Most private investors are still hesitant when it comes to investing into water enterprises as the perceived risks associated with the water sector are too high. Yet, private investments are indispensable in order to close the financing gap to reach SDG 6 by 2030. They can create spillover effects that go far beyond the water sector.

Thus, how can we steer commercial capital flows towards impact-oriented water entrepreneurship? Innovative financing mechanisms play a key role for the improvement of investment terms and de-risking as well as growing the water sector whilst attracting more private capital. There is still a lack of knowledge on how to finance water enterprises effectively. Particularly innovative financing instruments such as results-based payments in the context of water have not yet been sufficiently investigated.

Water Entrepreneurship Typology

In an attempt to shed light on this issue, this research project aimed to investigate the overarching question on how to better match water entrepreneurs with suitable investors and financing instruments. As a result, the outcome of the current project is to create a typology of water enterprises that eventually allows businesses and investors to identify suitable funding options and financing instruments.

Given that the water sector is vast, we decided to limit our scope to the wider freshwater sector such as water resources management, piped and non-piped water systems, water use in agriculture, households, industry, sanitation, wastewater management and reuse. We also focus our attention more on enterprises, which have considerable potential to scale and innovate, rather than focusing on infrastructure projects in terms of financing.

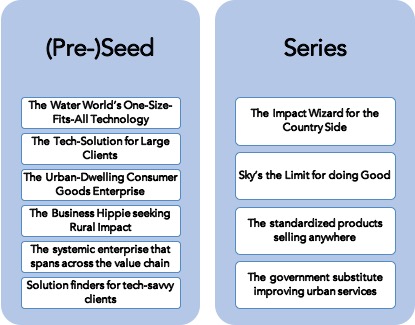

The typology is based on data collected of around 70 water enterprises and their relevant characteristics in regards to their business model, operating context, impact potential, team and experience and financial profile. The research also included around 20 interviews with investors and water experts in order to identify relevant investment criteria for the water sector. With the help of qualitative comparative analysis (QCA), a scientific method, we were able to determine ten water enterprise profiles across seed and series stage and match them with suitable investment options ranging from traditional to innovative financing instruments.

This Water Entrepreneurship typology is expected to provide knowledge on how to effectively finance water enterprises, more specifically on how to identify the most appropriate financing instruments for different water enterprise types. Instruments can range from traditional equity, debt, mezzanine and grant, to more innovative financing such as blended finance funds or facilities, impact bonds, outcome-based payments, water carbon credits and crowdfunding. This should give both entrepreneurs as well as investors some guidance on how to approach investments in the water sector and find a suitable match.