Executive Summary

The term sheet is a document providing a roadmap to definitive investment agreements that will control the key points of the investment deal, including impact investment deals that consider the triple bottom line. Developing a solid term sheet is essential for both investors and founders as it allows both parties to pre-define the most important financial, governance and impact issues of the investment transaction. The structure of term sheets depends on the individual investment, but there are common economic and control clauses, which are included in almost every term sheet. Knowing and understanding them is critical for a company since most of the clauses are negotiable.

Key Considerations

- Most investment deals start with a term sheet setting forth the terms and conditions of the agreement

- A term sheet is not a final investment commitment but is usually a pre-step towards a definitive financing agreements so the investor can eventually say ‘I am willing to provide money for these terms and the company is willing to accept the financing at these terms’

- A term sheet is in general legally non-binding, however there might be specific terms included that can be legally binding, including exclusivity and confidentiality

- It is difficult to change terms once they are drafted. Thus, the terms sheet needs to be carefully developed and negotiated by all parties involved

- As a young company, it is important to learn about term sheet content, structure and negotiation processes and work with a trusted advisor or an experienced start-up lawyer to help weed out the most important issues

- There is no standard term sheet. Depending on the type of investment, the stage a company is in and the kind of company and investor, term sheets can be simple or complex, conventional or non-traditional as they can also include mission and impact of impact driven enterprises and investors.

What is a Term Sheet?

A term sheet is a written document that includes the important terms and lays out preliminary conditions of an investment transaction. It is usually presented by the investor to the company prior or after the due diligence process, but always before executing the shareholders agreement. Term sheets are typically negotiated and evidence serious intent, although they are usually not a legally binding investment commitment. Ultimately, they act as a summary of the terms that will be drafted by lawyers in order to close the financing round.

Term sheets are very similar to “letters of intent" (LoI), meant to record two or more parties' intentions to enter into a future agreement, or a memorandum of understanding (or MOU) or heads of terms.

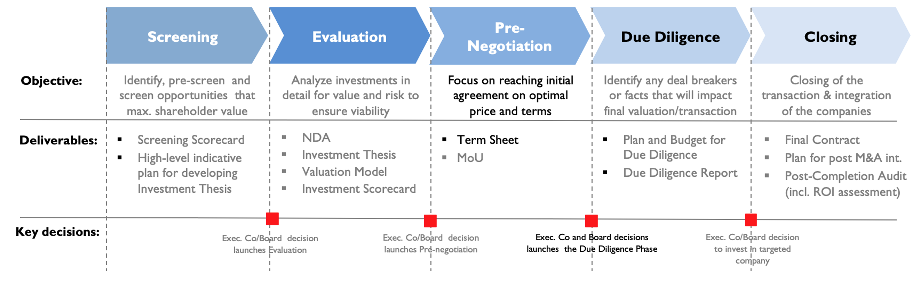

Looking at the investment management process, the term sheet is often drafted prior to the due diligence process and results from a negotiation between investor and enterprise around the specific investment terms before signing the financing agreement. The following graph provides one example of when and how a term sheet fits into the investment process, keeping in mind that every investor has a specific process and might require the term sheet at different stages:

Why is it Important?

Term sheets are important documents for both investors and founders for a number of different reasons as they:

- encourage both parties to focus on the most important financial, governance and impact issues in the transaction at an early stage;

- allow the parties to address any misunderstandings or critical issues;

- allow key legal principles to be settled, which in turn can be used as a framework for drafting the more complex, legally binding transactional documents;

- outline any conditions which need to be satisfied before binding documentation can be entered into;

- provide an outline of the process with regard to due diligence;

- outline the timetable for negotiation and completion of the transaction; and

- set out any binding elements which have been agreed between the parties.

The consequences of agreeing on a term sheet at an early stage of a proposed transaction are serious and once something is agreed, it may be difficult for either side to renegotiate. Most term sheets are in general legally non-binding, but they often include specific legally enforceable terms related to confidentiality and exclusivity, or even terms related to break fees if the deal is not going through for signing. Thus, it is critical to understand and negotiate such binding terms and keep in mind that during the time of negotiating a term sheet it is commonly good practice to not engage with other investors to shop for a better deal.

Nevertheless, term sheets can be understood as a currency, which allows founders to understand what an investor is able to provide for the company, giving a good indication of what it is worth.

Type of Term Sheets

There are a great variety of term sheet formats. Some of the key categories of term sheets include:

1. Grant Term Sheets with milestones when the donor is investing money in the company against specific milestones or metrics.

2. Debt Capital Term Sheets when the investor is lending money which will be repaid over a period with interest charges.

3. Convertible Debt Capital Term Sheets when the investor is lending money which can be converted to equity upon occurrence of a trigger or liquidity event at an agreed valuation.

4. Equity Capital Term Sheets when the investor is investing money in the company for a fixed percentage of shares.

Many standardized investment term sheet templates are available, in particular for the venture capital model. However, in the universe of funding alternatives, many alternative investment models exist such as corporate partnerships, joint ventures, venture debt, crowdfunding, revenue share and IP deals, combinations of growth capital and secondary transactions and earn-ins. There is ‘no one size fits all’ model, thus tailoring a transaction goes hand in hand with tailoring a term sheet.

Structure and Content of a Term Sheet

For some early stage pre-seed capital investments, term sheets might be simple, with limited details on rules and regulations, but a focus on clarifying how much money a company will receive and the rights associated with it. For most investments though, the complexity and components of a term sheet increases and covers amongst others the envisaged investment, deal structure and impact on the cap-table, development roadmap of a venture, board composition (roles and responsibilities) and key governance principles.

Traditional terms sheets usually do not include mission and social/environmental outcome related terms. However, in the case of water and environmental companies, it is relevant to discuss a term sheet structure that also identifies, articulates and enshrines social values, mission and returns into the impact investment transaction. One way of picking up impact-related topics can i.e. be to integrate them into the milestones for instalments of the investments.

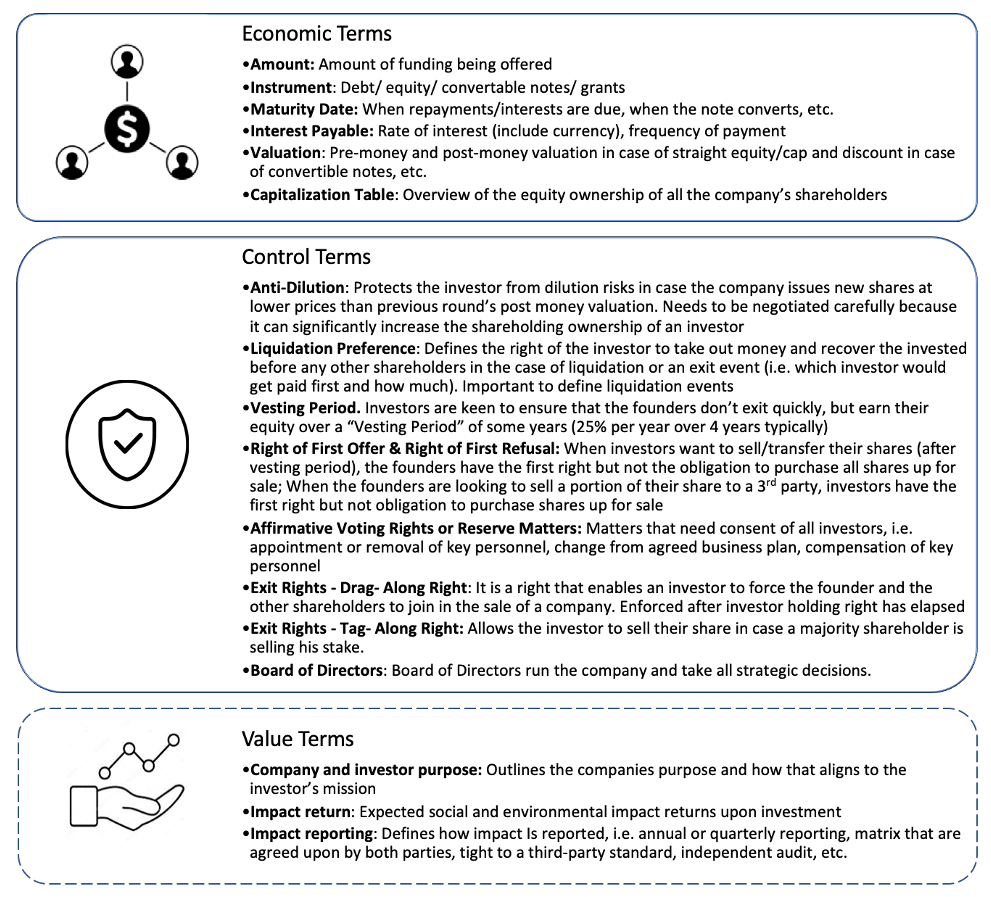

While it is highly advisable to involve an experienced advisor in the negotiation of a term sheet, it is important to understand key terms and concepts covered in term sheets and the implications for the company. The following list is not comprehensive but provides introductions into some of these most critical terms that would build the typical structure of a term sheet. The value terms are not commonly included and are rather relevant impact investment cases:

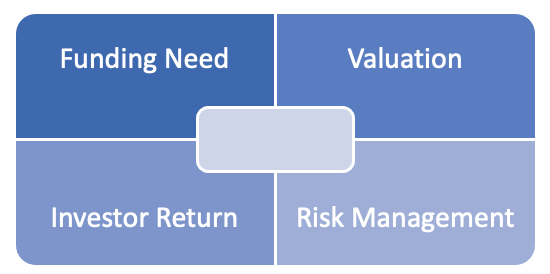

The term sheet quadrant is one possible method to facilitate founders and investors to better understand and design the key terms and conditions taking into account the stakeholders (company, founders, investors) needs, objectives and conditions. The term sheet quadrant takes into account the needs, objectives and conditions of the company, founder and investor from the perspectives of the funding need, investor return, valuation and risk management.

For each quadrant, a list of funding related topics can be discussed from the perspective of the start-up needs, founder objectives and investor requirements. Through the four lenses of the quadrant, founders, and investors learn to understand each other’s objectives and constraints as well as interdependencies between funding needs, return requirements, valuation and risk management. For example, the notion of milestone based funding commitments reduces the risk profile of a start-up.

Once the start-up needs, founder objectives and investor requirements are listed on the canvas, the inner circle is meant to write down possible solutions and deal terms.

How to Negotiate a Term Sheet

There are several pitfalls during term sheet development that should be avoided by the following groundwork and considerations:

- In niche sectors, like the water sector, many investments are often conducted by new-to-the game investors, DFIs or others, which means less of a standardized process and that more legal points and questions need to be tackled and negotiated.

- Before negotiating term sheets, founders (and investors) shall list and prioritize their deal breakers and be prepared to defend them throughout the negotiation process.

- The terms and clauses of a term sheet need to be looked at as a package, not in isolation. While negotiating, each side will usually win and lose some terms according to their preferences, thus it is important to predefine which are the most critical terms.

- Not only the investor, but also the company should do its own due diligence and view the process as a two-way due diligence exercise. The credentials of an investor should be thoroughly assessed beyond how deep their pockets are.

- Companies should seek neutral, legal and, if required also financial, advice. Contracting a lawyer with a track record in this area is important and a company should take its own decision on who to hire, not necessarily following investors’ recommendations. Nevertheless, legal advisors should at no point take control of the negotiation process, which is the role of the founders and investors.

- Any involved party need to do its homework on typical clauses and related limitations, methodologies and assumptions. A company should also have a good understanding on compliance issues (tax and legal) and their Intellectual Property.

- Companies should have data and information well prepared and document in order to respond quickly and smart to the due diligence requests from the investor.

- A debt/equity transaction is for the long term so companies should select the investor (Business Angel or VC/PE fund) with the strongest alignment in values, strategic priorities and exit strategy/timing.

- Term sheets do not mean that the deal is closed: When founders receive a term sheet they should not believe the deal is done, start increase expenses and think the money will soon be in the account. There is always a chance that the agreement is eventually not coming through and the company does not want to shut down because it was assumed that the money was already in place.

- The process of developing term sheets differs and might take a few weeks to several months. If during that time a company want to negotiate with other investors in parallel, it needs to make sure to negotiate well on the exclusivity and confidentially terms in the term sheet

- For impact driven companies, it is critical to tackle the notions on impact early on in the conversation with investor partners, before finalizing deal documents and due diligence. Ideally, the investor wants to work with the company in a way that can help further the mission of the company. Yet, when it comes to the definition of expected impact returns, targets and reporting need to be carefully defined and designed. The company doesn’t want to have their hands tight, thus they need a good formulation on the purpose and reporting.

Generally, investors intend to align themselves with a company in order to realize the expected returns, thus most term sheets should not contain highly aggressive terms. However, there are several term sheet clauses that commonly provide challenges to founders as they could lose control or economics or impact in their business:

- In listing the use of the funds focus on investments that will accelerate/validate scalability of the business model and strengthen its governance and control foundation.

- Pay attention to liquidity events avoiding at all costs guaranteed exit events with valuation based on a multiple of forecasted operating profit or revenue. It should always be based on actual valuation.

- Negotiate the exclusivity for the term sheet period not to exceed 2-3 months to avoid losing the interest of other investors.

- Spend time in understanding the impact of the list of Reserve Matters and Affirmative Voting Rights on the decision-making process. Try to negotiate whatever makes the management of the company easy without constantly going back to the investor.

- Always push back on the non-dilution and down-round protection clauses.

- Negotiate the annual fees not to exceed 1% upfront and 0.5% on an annual basis.

- Share the due diligence and legal fees among both parties. Do not accept to carry them alone.

- Don’t focus only on valuation; getting a higher valuation is good, but will usually imply that the investor will insist on stronger control clauses.

- Carefully define liquidation events in the liquidation preference term. The investor holding a preferred stock will get a preference over owners, employees and other shareholders. Multiples are used to determine the payment (1x, 2x of the investment). Try to push for only 1x.

- The vesting period is set to hold you accountable as a founder (or cofounders) of a company, but you can negotiate special clauses that would allow you to leave, i.e. in terms of sickness, specific exit conditions, etc.

- Right of first offer & right of first refusal are usually not critical to negotiate, but it is still important to understand how they work

- Watch out for the list of conditions precedent to an investment by the investor. The longer and more complex the list, the longer the cycle for term sheet negotiation and closing the fundraising cycle.

- Make sure that your documented metrics and milestones are realistic and that you can deliver on them.

Avoid severe equity dilution in the first two equity rounds as you will go through 3-5 rounds and would prefer to have an interesting equity share at your exit to compensate for all your value creation efforts.