Executive Summary

The Investment Readiness Benchmarking tool focuses on the key success factors of water related start-ups from a business and impact angle. It allows us to evaluate their performance through comprehensive indicators which are directly tied to the proof of business model, the impact potential, prospects for market success through innovation and capacity to deliver, manage and finance. It builds on first-hand experience from impact investors, cewas’ expertise supporting 400+ water and sanitation start-ups and academic validation through the University of Zurich’s Centre for Sustainable Finance and Public Wealth.

The Challenge

In today’s challenging business environment, access to capital is key for young and growing water enterprises. The conditions to raise impact-driven capital are particularly demanding when it comes to water-related businesses in developing contexts. On top of this, investment opportunities along the risk-return-impact spectrum are often hard to come by.

At the same time, finding investments that not only deliver competitive risk-adjusted returns but also generate social and environmental returns remains a key challenge for impact investors today.

So what could explain this? Firstly, businesses and support organisations lack clarity on the needs of different types of investors. Secondly, investors struggle to understand the sector specific challenges entrepreneurs face. And finally, there is a lack of innovative financing instruments that are suitable for different types of water-related businesses.

The Solution

Together with a network of impact investors and financing experts, cewas and the Center for Sustainable Finance (CSP) at the University of Zurich have developed an Investment Readiness Benchmarking tool. The aim of this tool is to solve the above-mentioned financing issues by building a strong investment pipeline for water enterprises which will allow for better matchmaking between investors and promising water enterprises.

By determining the status of investment readiness, the tool establishes the basis to improve the foundational issues of the enterprise in terms of commercial viability. It helps evaluate the business model, impact logic and operational performance of the water-related enterprises by revealing its strengths and weaknesses. On the other hand, investors can easily assess the potential for financial returns on investment and impact potential of the business and compare this to the benchmark for water businesses.

How it works

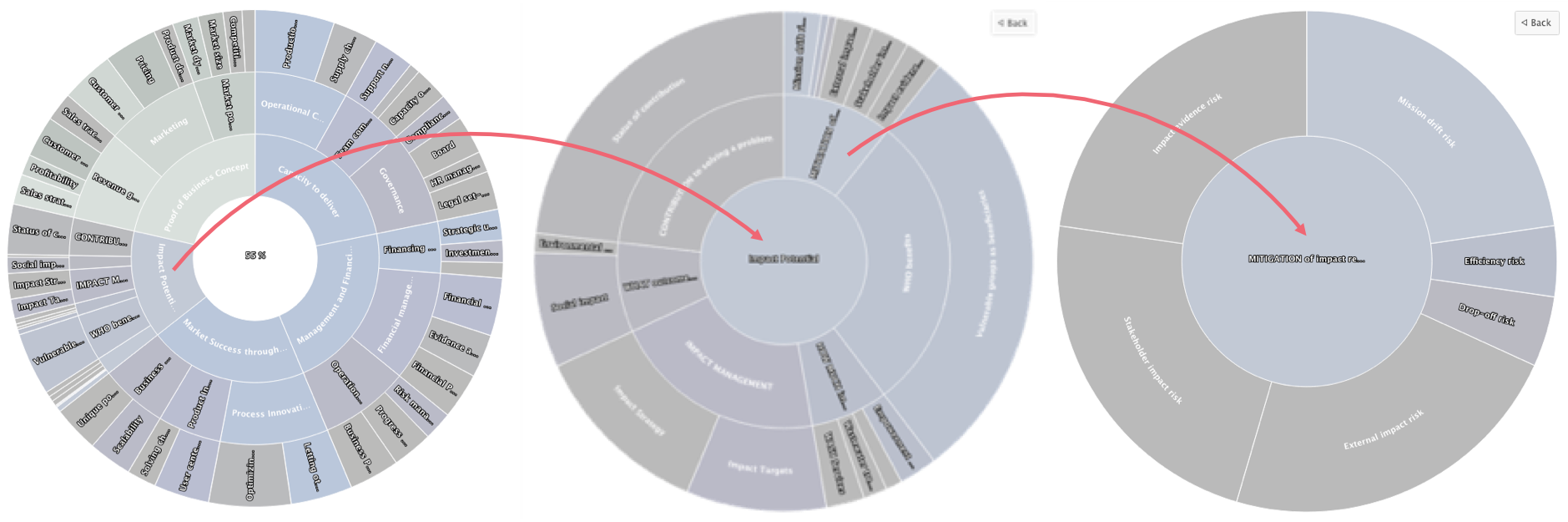

The benchmarking tool is organised around five domains which are relevant for impact enterprises in the water, sanitation, waste and agriculture sectors. In order to gain a comprehensive overview of the performance of the enterprise, each domain examines vital success factors of a water enterprise. All domains use a mix of qualitative and quantitative questions that assess the enterprise’s: 1) proof of business concept; 2) impact potential; 3) prospect for market success through innovation; 4) management and financing capabilities and, 5) capacity to deliver.

The tool uses different sets of indicators to evaluate these domains for enterprises at different stages of maturity: 1) pre-seed; 2) seed and, 3) later investment stages. The results are visualised in a sunburst diagram through which one can analyse and zoom into the different levels of detail of the business’ investment profile.

The benchmarking tool makes the vital link between water entrepreneurs and impact-oriented investors. Through its comprehensive nature, it allows investors to find suitable investment opportunities while providing water enterprises with the necessary support to improve their investment readiness. For entrepreneurs, the tool provides orientation on their journey towards investment readiness.

Analyse your business here to find out where you need to improve to access investments.

Benchmarking Domains

Proof of business concept

As any other business, water enterprises need to demonstrate that their product or service has particular market potential, attracts customers, generates revenues and it is financially viable. This domain provides an in-depth assessment of the validity and commercial viability over a sustained time of the business idea.

Impact potential

Generating impact is the key outcome for every social enterprise in the broader water sector. Thus, evaluating the ability of the business to produce and report on the promised impact is the main goal of the domain “Impact Potential”. The questions are tailored towards water-related enterprises and structured along the five dimensions of the widely recognised ‘Impact Management Project’ (what, who, how much, contribution, risk) to evaluate the impact strategy, proof of impact, impact management practices and the enterprise's contribution towards more sustainable sanitation and water management and consumption patterns.

Market success through innovation

This domain looks at the innovative power and capability of the enterprise in terms of their business model, processes and product. It recognises that innovation can not only help water businesses strengthen their position in the market and successfully build a long-lasting advantage over their competitors, but can also be a key driver for impact.

Management and Financing

To build sustainable businesses within the water sector, businesses must focus on developing a clear plan and concrete steps for how to execute their business idea. Sound management and clarity around financial aspects of a business model are therefore key aspects for every business. The respective domain in the benchmarking tool evaluates the enterprises’ operational and strategic planning, financial management and its financing strategy.

Capacity to Deliver

To deliver upon the objectives included in the business plan, the water enterprise needs to develop capacities and resources, including a capable team, the right legal set-up, production and technical capacities, partnerships, etc. In order to paint a full picture of the business’ “Capacity to Deliver”, the respective domain evaluates the team composition, the corporate governance and the operational capacity of the enterprise.