Executive Summary

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return (GIIN, 2019). Impact investment plays a vital role in order to provide the necessary financing for enterprises to enable them to contribute towards the targets set out in the Sustainable Development Agenda of the United Nations. Investments in water are particularly important to reach sustainable and inclusive growth, due to its interlinkages with and spill over effects on other crucial impact themes, leading to the realisation of multiple Sustainable Development Goals (SDGs) such as poverty reduction, health, and clean energy.

In the following sections, we will look at the definition of impact investment and its key elements. Subsequently, we will analyze the Omidyar’s concept of the returns continuum that suggests a framework of funding that covers a spectrum of investment options ranging from commercial investments to grants. Finally, this factsheet provides a few insights into impact investing in the water sector.

What is Impact Investing?

According to the Global Impact Investing Network (GIIN), Impact Investment can be defined as investments made in companies, organizations or funds with the intention to generate positive, measurable social and environmental impact alongside a financial return (GIIN, 2019). Capital providers are typically individual or institutional investors such as pension funds, foundations, DFIs (development finance institutions), and banks. Investments are not limited to a particular asset class, sector or region, but are typically more in the private market (private equity, private debt). The returns expectations can vary from below market rate to market rate return. The capital provided is deployed to address pressing challenges often aligned with certain Sustainable Development Goals (SDGs) such as poverty alleviation, renewable energy, conservation, microfinance and access to quality education and jobs.

Impact investing typically fulfils the following core characteristics:

- Intentionality

- Return expectations

- Range of return expectations and asset classes

- Impact Measurement

Unlike traditional investments, the impact investor intentionally seeks to finance solutions that contribute to positive social and/or environmental impact. Thus, at the core of impact investments is the investor’s intention to solve issues with a particular impact lens (1).

Besides the social and environmental benefit, the impact investor also expects a positive financial return on her capital, which sets her apart from philanthropic capital, where the return expectation is zero. The return expectation can vary, but at minimum, the investor aims to recover the initial investment without additional return (2).

The return can range from below market rate (also called concessionary) to risk-adjusted market rate, or at minimum, a return of capital. This is different compared to purely philanthropic investments, which do not aim to generate a return nor recover the original amount. The form of impact investing is also not limited to a specific asset class. It covers a broad spectrum of instruments such as equity, debt to quasi-equity, primarily in the private market (3).

One key element of impact investment entails measurement. Impact investors are committed to measure and report social and/or environmental performance of their investments. This is vital in order to ensure transparency, comparability and accountability throughout all impact investments (4). Metrics and particularly standardized metrics play an important role in order to support credible and effective impact measurement.

For more information on impact measurement go to IRIS, IMP, the GIIN or the impact toolkit from the GIIN.

Impact Investing across the returns continuum

One of the key questions in impact investing that has given rise to numerous discussions is whether there is a trade-off between social/environmental impact and financial return. Even though, there are strong advocates on both sides, there is not a clear cut yes or no answer to this question.

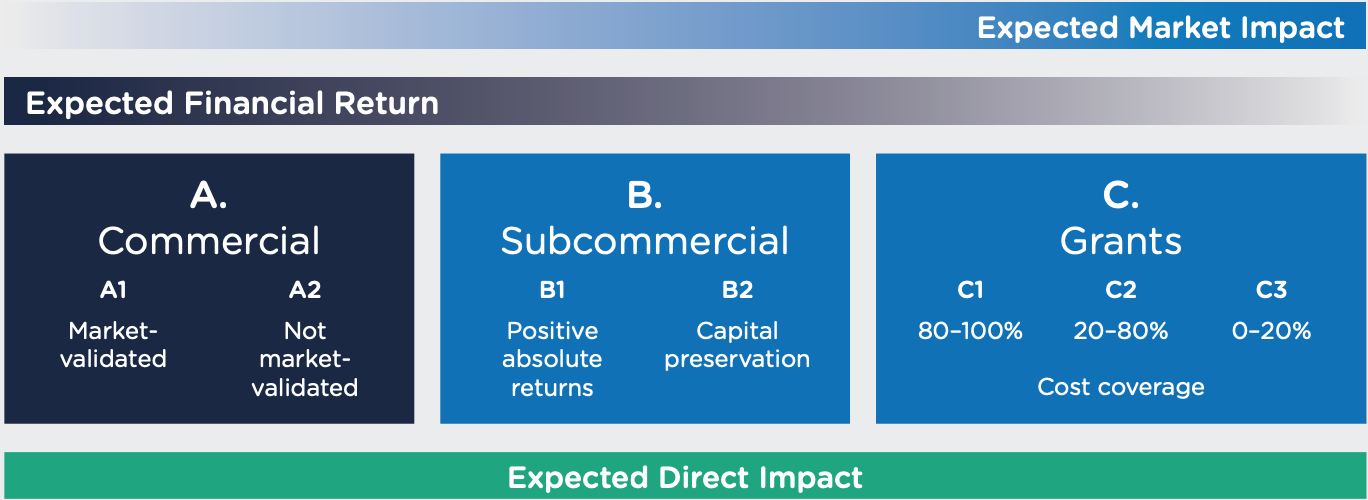

Omidyar Network, a philanthropic investment firm, believes that the answer to this question depends on the enterprise’s ability to create market impact. Some of the enterprises involve a trade-off between social/environmental impact and financial return, while others don’t. Omidyar has developed a framework that captures investments across the returns continuum, extending from fully commercial investments to philanthropic grants (2017). The framework enables not only investors, but also entrepreneurs aiming to attract impact capital, to look at impact investment not as a binary choice between financial return and impact, but as a spectrum of choices that allow for sub-commercial capital and grant capital alongside commercial investments.

The proposed framework highlights the importance of market-level impact. Companies that contribute to building or shaping new markets have the potential to generate extraordinary social or environmental impact that extends far beyond its immediate firm-level impact, making it vital for the system. A company can achieve market level impact in three ways: pioneering a new business model (e.g., microfinance institutions), providing industry infrastructure (e.g., microfinance currency hedging firm) or influencing policy (e.g., firms that catalyze policy change in education).

The framework differentiates between three investment types according to expected financial return and market impact: A) Commercial, B) Sub-commercial and C) Grants (see figure above). As we move along the continuum, the expected level of market impact increases, while the expectation of financial return decreases (a direct firm-level impact must be given in all cases). A company can be assigned to category A, if the business can provide a positive social or environmental impact (firm-level impact) as well as commercial return. Yet, market impact is not a requirement. For businesses in category B, investors should accept the prospect of lower financial returns in exchange for the promise of high market impact (2017). Category C businesses are unlikely to provide financial return or repay the grant but the potential for market-level impact is significant.

Due to the business’ focus on low-income consumers, the need for high-risk patient capital is particularly high for sub-commercial and grant-level enterprises, as these markets take some time to develop. However, the potential for market transformation is significant. Businesses operating in the water sector are likely respond to the principles laid out in the returns continuum. While commercial financial returns are currently more difficult to achieve, the business’ overall social and environmental as well as market building impact is likely to be immense.

Impact Investing in the water sector

The importance of businesses operating in the water sector cannot be overstated. The water sector is strongly interlinked with other targets of the Sustainable Development Goals (SDGs) and often have mutually reinforcing connections. Thus, a positive change in the access to water supply, sanitation and hygiene will significantly affect the achievement of other SDGs such as education, poverty reduction, health or energy. In this sense, any positive outcomes from investing in the water sector will spill over to other impact themes.

Working towards the achievement of SDG 6 offers a clear business case. A study of the World Health Organisation (WHO) found that the global economic return on sanitation spending is $ 5.5 per US dollar invested (2018). Also, given the current covid-19 pandemic and its consequences, we can’t overstate enough the importance of promoting good hygiene. The WHO also found that WASH is the most effective investment strategy in health with six lives saved per $100 invested (Actiam, 2020).

Despite the clear benefits in investing in the water sector, businesses are still struggling to attract capital. According to GIIN (2020), capital allocation to the WASH sector grew within the last couple of years. Yet, in order to meet SDG 6 by 2030 we still require $114 billion per year of capital investments (World Bank, 2015). The capital required can be deployed by companies working along the water cycle, such as water conservation, water distribution, energy, agriculture, water treatment, menstrual hygiene and waste water management. In order to be considered by investors, businesses need to clearly measure their impact which further adds to the challenge.

Fortunately, investors seem to be increasingly interested in the water sector. According to the GIIN (2020), WASH is the fastest-growing sector, with allocations growing at 33% from 2015 to 2019. This upward trend seems to continue in the next years (GIIN, 2020). Yet, most WASH investments (within the survey group) went to developed markets rather than emerging market (10% AUM versus 1%), despite the fact that emerging markets are likely to have a higher demand for access to basic services in WASH. There are also only a few below-market investors that invest in WASH compared to market-rate investors (6% vs 1%).

This shows that investors still hesitate to allocate their capital due to their expectations in regards to return, size of investment and impact. Actiam, an asset manager, states that the water sector still requires market-building efforts in emerging markets (2020).