Executive Summary

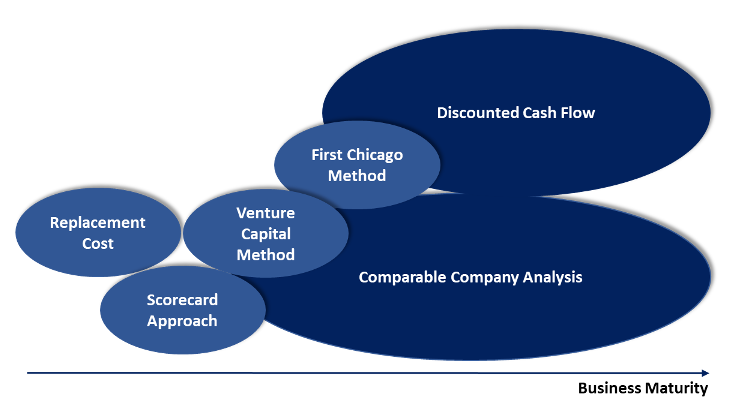

Doing business valuations at first sounds scary but they are part of the skill repertoire every entrepreneur must have. When examining the fair value of your business, you will quickly realise that this is no straightforward process. In fact, you have a variety of different valuation methods to choose from, which all have their pros and cons. There are, however, methods which are suited more than others depending on the maturity of the business. In this factsheet you will learn about four methods specifically designed for early-stage companies and two general methods for more mature companies. Knowing the value of your company can be useful for various reasons. For instance, it helps you to determine the share price, attract funding, and measure company success. But most importantly, it prepares you for future negotiations with investors. The presented methods will give you a rough idea what your business is worth, but ultimately the value of the company is negotiated in an agreement between you and the investor. For example, an investor might agree to a higher valuation, if you have a business concept that has the potential to create social or environmental change.

Key Considerations

- Valuation is the process of assessing the fair value of a business. There is not a single right way to do it; the process remains more an art than an exact science.

- Both investors and business owners make their own assessment. The results serve as the basis for subsequent negotiations between the two.

- Company valuation helps you, as business owner, to determine the share price, obtain and maintain financing, measure success, and observe performance.

- When preparing for negotiations on your company’s valuation, you must consider both quantitative and qualitative factors.

- Early-stage company valuations are challenging since at this development stage the company has little to no historical financial data.

- The value of a business changes over time, so you should conduct regular valuations (ideally once a year).

- Depending on business stage different valuation methods can be applied and combined.

What Is a Business Valuation?

The process of assessing the current worth of a business is called company valuation. An accurate valuation is a complex procedure which involves a variety of factors. In fact, there is no single right way to do it, the method applied very much depends on the purpose and objective of the valuation as well as the size of the business. You can think of the valuation process as a box with a variety of different possible methods to pick from according to your needs and preferences. But no matter which procedures you choose, a valuation normally comprises a measurement of the competitive position within the market sector and an evaluation of future company earnings as well as some qualitative criteria (McCabe 2018).

The methods described in this factsheet help you to assess the value of the business, and at the same time you get an understanding of how interested investors proceed when evaluating your company. Because, keep in mind, regardless of the valuation you do, investors will always do another assessment on their own. Consider the results of the described valuation methods as a starting point of a negotiation between you and the investor rather than a fixed absolute value. Because ultimately the worth of the company will be a formal agreement. When applying the presented methods, you might get a lower valuation than you initially hoped for. But if you have a convincing personality, you can still manage to raise the company value in a negotiation. Bear in mind, too high valuations are also not desirable because it will make it more difficult to attract funding in further rounds.

Why It Is Important

This leads us to the first reason why business valuations are crucial for business owners. If you can put yourself in the shoes of an investor, you will have more confidence in the negotiation and can quickly identify a bluffing investor (Richards 2019). In other words, the better informed you are about the worth of your company, the higher your chances of getting a good deal. Valuations are a further opportunity to get noticed by investors and thus, are an important step to secure external funding (CFI 2017, Valuation).

To raise capital, your start-up will usually have to go through several funding rounds. In each round, the business is independently evaluated. The evaluation process enables you to determine an estimate of the company`s equity share prices and gives a rough idea what to expect in a future sale of the company (Hayes 2020). This is important, since you want to know how many shares you are letting go for a certain amount of funding. As a business owner, valuation also helps you to assess the price of new shares after new shareholders are added.

When scaling a business, regular valuations make sense and provide a good measure of how the business is doing. As the business grows, the value usually increases. Hence, valuations can be used as a management tool to measure success and observe the performance of the company. Therefore, you should carry out a valuation at least once per year.

The Challenges of Start-Up and Early Business Valuation

Valuing young companies is a challenging endeavour. Early-stage businesses have, by their nature, a lack of historical data available. Consequently, valuation at this stage quickly get speculative. Some may not even have generated any revenue or profits yet, and young companies often face large expenses during the establishment of the firm. Valuation is also challenging because of the high failure rates of young companies. At the same time, most early-stage businesses are dependent upon venture and equity capital or external funding in general (Coffey 2018).

Some of the common methods like the Discounted Cash Flow or Comparable Company Analysis (see more details below) use financial records as input data. At early stages of development, enterprises may not yet have revenues or a solid financial history, such valuation approaches are not suitable. There are, however, methods specifically designed for start-ups, like the Replacement Cost Method, Venture Capital Method, First Chicago Method, or the Scorecard Approach on which we have compiled more information and guidance below. But sooner or later you will realize that there is no precise valuation method for early-stage companies. Thus, experienced investors and analysts usually carry out a few different valuation models and take a decision based on the weighted average of the results. As an entrepreneur, you can do the same and use different approaches to build solid arguments for a high company valuation in preparation of investment negotiations.

Qualitative Factors Influencing a Company Value

Assessing the company`s worth, is more than just juggling with the right financial ratios. In fact, there are several quantitative criteria that you must consider, to get a more profound valuation. If you value a business that has not yet generated any revenue, the qualitative assessment becomes especially necessary. The following are example of important factors that influence the worth of your business. If you can answer these questions with “Yes” the company`s worth increases.

Provide proof of scalability (Dworén 2020)

- Number of users – Can you prove that you already have a customer base?

- Marketing strategy – Do you have a strategy to attract new customers?

- Prototype – Is there already a Minimum Viable Product or even a prototype?

- Growth rate – Can you present numbers that the business is growing?

The Composition of a Founding Team

- Proven experience – Do the founders have prior success in starting a company?

- Skills diversity – Are relevant complementary competences represented?

Supply and Demand

- Market competition – Can you outcompete the competition?

- Emerging industry or trending market– For investors, it is favourable if you are playing in a booming industry like fintech or biotechnology; while this hardly applies for water related business models, you can make the case for the urgency of the challenge you address you address in combination with its economic potential.

Capitalizing on Impact

More and more investors are not only interested in generating a financial return but are also looking for opportunities that achieve a social or environmental impact. The impact potential of your company thus, can be another important criterion to consider in a company valuation. Maybe your company has not yet proven to be financially fruitful or your customer base is lacking. But if your business concept has the potential to help people or the environment, it can drive the company value. In certain circumstances, an investor will accept slightly lower financial returns, when his or her investment has the potential to generate impact on a societal level. Investing becomes particularly impactful on a market- level rather than a firm-level. Hence, pioneering businesses which have the potential to catalyze a whole new market sector are particularly interesting for impact investors. Whenever you are facing an impact investor in a negotiation, point out how your business plans to generate social and environmental impact (that goes beyond just delivering value to your customers) (Bannick et al. 2020).

Different Methods to Value a Business

The Discounted Cash Flow and the Comparable Company Analysis are the most common methods to value a business. They are suitable for businesses that already have a financial track record. The other procedures, Replacement Cost Method, Scorecard Approach, Venture Capital Method, and the First Chicago Approach, are situation specific methods that were specifically designed for early-stage businesses with little to no historical data available. Nevertheless, start-up valuation methods still make use of classical valuation elements like comparing financial ratios (Cremades 2018).

Replacement Cost Method

The Replacement Cost Method is a valuation approach generally used for young businesses which have not generated any revenue yet. It attempts to examine the value of the company today by calculating the so-called replacement costs. These costs refer to the amount of money needed to replace the key assets of the businesses at the present time and according to their current worth. Assets are a broad term for any items a business owns, including things like cash, office equipment, machinery, or buildings. To get a valuation value the replacement costs of the key assets are then multiplied by a multiplier (Wasiak 2020).

#1 Identify the business assets

As a first step you must identify your business assets, then value each asset separately and finally sum up all the asset valuations to arrive at the total replacement costs.

#2 Choose a multiplier

In a second step the replacement costs are multiplied by a multiplier. Investors choose this factor based on their experience. If the investor expects the company to be successful, the multiplier will be set higher and the business value increases. While the value of the key assets is only partially negotiable, an entrepreneur can plead for a higher multiplier by providing solid qualitative arguments.

Scorecard Approach

The Scorecard Approach is a valuation method particularly designed for start-up valuations. But unlike the other methods this approach does not rely on financial calculations. Therefore, you mainly apply the Scorecard Approach in the earliest stage of a business lifecycle. The core of the methodology is a valuation scorecard with different qualitative factors, where the target company is compared to similar start-up ventures. The method is based on a similar principle as the Comparable Company Analysis (see more details below) but without quantitative ratios (Venionaire Capital 2017).

#1 Assess the average valuation for pre-revenue start-ups

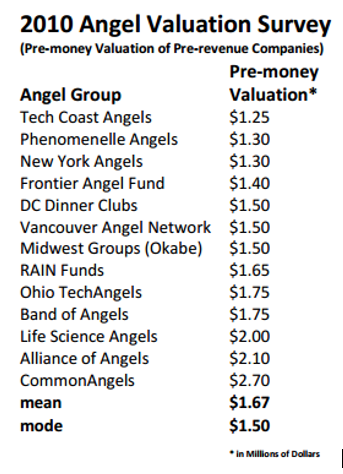

At first, you should try to determine the average valuation of similar start-ups. Focus on start-ups within the same or a similar industry (e.g., enterprises that offer solar home system solutions may have similarities with innovative solutions for decentralized water or sanitation services), business stage and geographical region. Several databases such as AngelList or Crunchbase can provide information on company valuations. Be prepared to contact similar companies directly if you cannot find suitable information in such databases. Also, a regular exchange with experienced angel investors or investment advisors could help gain a better understanding. Make a list with the pre-money valuations of the 10-15 similar start-ups and take the average value. The pre-money valuation refers to the value of the company before it receives funding from investors. In the example below, a pre money valuation is conducted for a group of tech companies. The same principle can be applied using a group of impact generating companies in the water sector. In the example, the average valuation is $1.67 million. This value will serve as a basis for further calculations in step three.

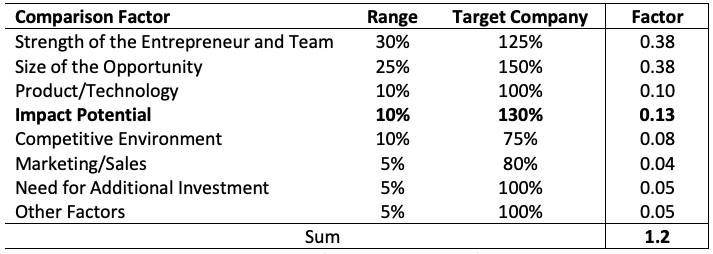

#2 Comparing Factors

The next step is to determine comparing criteria. Assign for each criterion a weight. The weighting is a subjective choice; some analyst values the quality of the management team higher than the quality of the product and vice versa. It is generally believed that a strong team composition and the good market opportunity are two of the most important success factors. Factors like your water-related impact (e.g., the number of people that gain new or improved access to water supply, sanitation or waste management solutions) may be important if you target impact-investors, but may not be considered by more commercial investors.

A possible list of comparing factors with the allocated weights could look like this:

- The strength of the Management Team (30%)

- Size of the Opportunity (25%)

- Stage of Product / Technology development (10%)

- Impact potential (10%)

- Competitive Environment (10%)

- Marketing Strategy / Sales Channel (5%)

- Need for Additional Investment (5%)

- Other Factors (5%)

#3 Valuation

In the third and last step of the Scorecard Approach, all factors are scored. If the category lies in the norm, it is scored with 100%. A score higher than 100% represents a higher-than-average evaluation, while a score lower than 100% represents a lower-than-average evaluation. In the given example, the start-up is in a highly competitive market environment with a score of only 75%, which means that it underperforms as compared to similar start-ups. However, with a score of 130%, the company overperforms with regard to the impact potential. The weightings are then multiplied by the relative company scores. With an average pre money valuation of $1.67 million and a summed factor of 1.2, we get an overall valuation of roughly $1.8 million for the target company.

Venture Capital Method

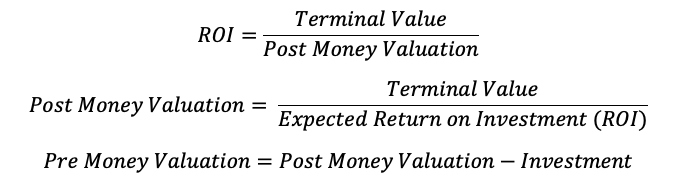

As the name implies, the Venture Capital Method (VCM) is also mainly used in the early start-up phase. The method is suitable for businesses that are either on the verge of generating revenues or have already started. It is particularly useful for venture-capital investors who seek to capitalize on their investment 3-7 years later by selling their shares. But if you know the principle, you can use the method to determine the company value like an investor. The idea is simple. First, an expected exit price for the investment is anticipated. From there, you can calculate back to the today’s post-money valuation, taking into account the risk the investor takes. After that you simply subtract the initial investment amount.

The investor sells his shares at a price of the terminal value. Sometimes this value is also called the exit value because it refers to the exit of the investor. This value equals the amount of money you would get if you sold the company at this point in time. To calculate the future terminal value of the company, standard valuation methods (see more details below) can be used. Commonly investors make use of financial ratios which they compare to similar businesses. Alternatively, the Discounted Cash Flow Method can be applied. Because the terminal value lies in the future, it needs to be discounted back to today’s value, which equals the post money valuation. This is usually done with the factor that represents the investor’s expected rate of return on investment (ROI). Because venture investments are still associated with high risk, a reasonably high rate of return of the initial investment is anticipated (Gordon 2020, VCM). On average, the rate is around 20%, but this is matter of individual preferences and risk profiles. The pre money valuation can afterwards be simply calculated by subtracting the initial investment (Venionaire Capital 2017).

The following formulas illustrate these calculations:

Example: Let´s do an example together. First, we need to calculate the terminal value. We know that the terminal value is the anticipated selling price for the company at some point on the road – let’s say 3-7 years after the investment. With standard valuations methods (see more details below), we calculate a terminal value of 40 million dollars. Further, we assume that the investor invests 500 thousand dollars, and the anticipated return of investment is 20x.

Using the formulas from above:

Post Money Valuation = Terminal Value / ROI = $40 million / 20x = $2 million

Pre Money Valuation = Post Money Valuation – Investment

= $2 million – $ 500 thousand = $1.5 million

First Chicago Method

Like the Venture Capital Method, the First Chicago Approach is primarily used by venture capital and equity investors. To sufficiently prepare for the negotiations, it is certainly advantageous to know this method as an entrepreneur. The FCM combines elements of the Discounted Cash Flow method and the Company Comparable Analysis. At the same time, it takes different scenarios for the best, average, and worst cases of the company development into account. This method is one of the more complex approaches to value a start-up. Unlike the Venture Capital Method, this approach is more sophisticated and time consuming (Gordon 2020).

#1 Create different Scenarios

As a first step, three business performance scenarios are created. For each scenario – worst case, base case, and best case – a separate valuation is performed. The worst-case scenario projects company performance where things go worse than desired. For instance, the product cannot compete in the market and little to no revenues are generated. On the contrary, the best-case scenario projects a company performance that beats the expectations. The method starts by projecting future cashflows of the company for each scenario. Because of the lack of data available, this is very speculative. In an additional step, the projected cashflows are used as input data for a Comparable Company Analysis, which yields the terminal value. Both the terminal value as well as the projected cashflows are discounted back to their present value. Depending on the rate of return chosen by the investor, the discount rate varies (Venionaire Capital 2020, FCM).

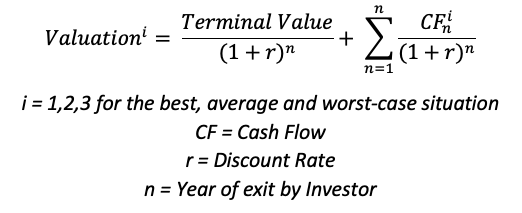

These explanations can be illustrated with the following formula:

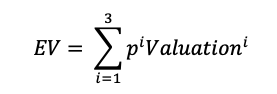

#2 Probability allocation to each scenario

In a second step, the results of each scenario are assigned with a probability. These probabilities should be in accordance with the initially defined scenarios. Then all valuation results are multiplied with this probability and added up to one weighted average valuation. The overall valuation then equals the company value. Because different scenarios with varying risk profiles are taken into consideration, the possibility of an inadequate valuation diminishes. The method can be arbitrarily complicated by adding more scenarios.

Example: The valuations for the three different scenarios are as follows:

- Best Case = $5 million (30% chance)

- Average = $4 million (60% chance)

- Worst Case = $3 million (10% chance)

The final Enterprise Value is then: $5m*30% + $4m*60% + $3m*10% = $4.2 million

While you may not apply this entire FCM valuation process as an entrepreneur, the exercise to think of best, average and worst-case scenarios and arguments for their likelihood can be a good exercise to prepare for investor negotiations.

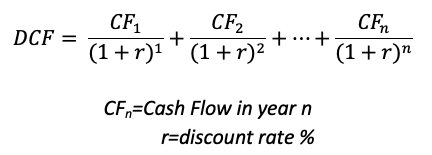

Discounted Cash Flow

This valuation method tries to anticipate the value of the company on the basis of future performance. One way to measure performance is looking at the cash flow of a company. In the essence, it is the increase or decrease of the amount of money a company has in the end of the year. It is a good indicator how financially liquid a company is, and thus, often used to value a company. The forecasted cash flows need to be discounted with an appropriate discount rate. To grasp the concept of the discount rate, think of it as a factor that is applied to compensate for the risk the investor is taking because there is a probability that the company is not receiving the total amount of the expected cash flows. The higher the risk involved in the investment, the higher the discount rate, and the lower the resulting valuation. The discount rate is applied to reduce the value of the future cashflows.

Investor often do not have the full picture of what is going on in the company. Your job as an entrepreneur is to lower their perceived risk by providing them with the information they need, and thus, reduce their risk perception with regards to the investment into your company.

In a nutshell the DCF assumes that the generated cash flows by a company can be used to pay back the capital providers. It is an intrinsic valuation because the analysis relies on the financial records of the business rather than market factors. If the total value of the discounted cashflows is higher than the current costs of the investment, it might be an attractive opportunity for investing (Fernando 2020).

A DCF valuation can be conducted in three main steps. Start with estimating the expected cash flow. Then, as an entrepreneur, you should understand how investors establish and apply discount rates as part of the valuation. Compile arguments that lower the investment risk to argue for a favorable discount rate. Estimate what is a realistic discount rate to aim for to apply DCF to estimate the valuation of your company, and examine the present value of all discounted cash flows using an excel table or spreadsheet. These steps require many assumptions, which is the main limitation of the DCF method. If the future cash flow projections are valued too high, the investor will negotiate the company valuation down, as it might otherwise result in an unprofitable investment; if they are estimated too low, you may end up asking for a too low valuation.

#1 Estimate the expected cash flows: The cash flows of a company are the financial resources available for distribution to the owners of the company. To obtain the free cash flow (FCF), the earnings generated by operating activities are subtracted by taxes, as well as the funding of capital expenditures (CAPEX) and the change in working capital.

#2 Select a discount rate: If you apply this method as an investor, you would establish a discount rate based on the data you received from the company in combination with your experience and database of valuations of other companies. Depending on the chosen discount rate, the value of the company can severely differ. In essence, you need to understand that investors expect a return for their initial investment. So, the rate usually just represents the required return of investment. If an investor perceives an investment as not risky, the discount rate should be lower and vice versa. As an entrepreneur, you should therefore systematically develop arguments and evidence that convince the investor that he or she takes a lower risk by investing into your company.

#3 Calculate the terminal value DCF: All cash flows are discounted and added up according to this formula (CFI 2017, DCF Formula). It is more uncertain to anticipate cash flows that are further in the future. Thus, a cashflow in year three is discounted heavier than a cashflow in year two.

Example: An entrepreneur wants to estimate the DCF for a period of the next three years with a discount rate of 10%. Using the formula from step one, she calculates a free cash flow of $100´000 per year. She then discounts the cash flows by 10%. The value of the first year´s cash flow is $90´909, the second year`s cash flow is worth $82´644, and the third years cash flow equals $75´131. All three cash flows summed yields a DCF of $248´684. If the investments costs are below this value, the investment is profitable. This number is thus important for investors and for you as well if you want to attract funding.

Comparable Company Analysis

The Comparable Company Analysis (CCA) or “Comps” is another very common method to assess the company value (CV). Investors or analysts using this approach compare financial metrics of similar businesses operating in the same industry. A compiled list of statistics from a peer group serves as a basis of evaluation. This helps investors or analysts to assess whether the company is over- or undervalued. Unlike the DCF valuation, you can use the Comparable Company Analysis to estimate the value by comparing your enterprise to other companies. Combining both methods can sometimes be a powerful tool to gauge the true worth of a company. For instance, a Discounted Cash Flow analysis yields that the share price of the company is $40, but a Comps Analysis then indicates that comparable businesses in the same industry are worth more. In this case you can use the Comps approach to argue for a higher valuation and negotiate a better deal with the investors. The CCA uses real market data as input and is not based on optimistic assumptions. However, it might prove a challenge to find truly comparable companies. This method is less accurate for early-stage businesses (CFI 2017, CCA).

#1 Find the right peer group: Since comparing the value of apples to oranges does not make any sense it is crucial that businesses are only compared to similar businesses. The first step is figuring out which companies have similar characteristics. A peer group check can include the following criteria: industry classification, geography, size (revenue, employees, assets), growth rate and margins. Ideally the valued company should be compared against 5-10 other businesses. While investors usually have access to a large pool of data on company valuations, you can explore websites like Bloomberg, Capital IQ of FINVIZ to look up the needed information. Alternatively, useful information can be found in the company’s annual and quarterly financial reports or by directly contacting companies you want to benchmark against.

#2 Gather information and determine the metrics: Depending on which stage the business is, different metrics are preferred. This method is not the first choice for young start-ups but can still be used for early-stage businesses. To perform the analysis, the necessary information needs to be collected for each comparable company. Once the important information is gathered, a excel sheet can be used to present the relevant information.

The excel sheet should include the following points:

- Share price (= Price of a single share, fluctuates according to market conditions)

- Market capitalization (= The total number of shares multiplied by the current share price)

- Net debt (= Metric to measure the financial liquidity of the company)

- Company value, CV (= Comprehensive measure of the company’s total value)

- Revenue (= Income generated by business operations)

- EBITDA (= Measure of the overall financial performance, it represents the amount of profit a company receives before interest, taxes, depreciation, and amortization are subtracted)

- Earnings per share, EPS (= Company profit divided by the total numbers of shares)

#3: Calculate the metrics: Using the financial information of the previous step, the comparable ratios can be calculated. When using the CCA for start-ups that already create revenue, the EV/Revenue can be used. Otherwise, this method is better applicable to mature companies. The main ratios to compare include:

- Company value / Revenue

- Company value / EBITDA

- Share price / earnings per share

#4 Interpret the results: When all ratios are calculated, results can be interpreted. The ratios of your company can be compared to an average ratio of comparable companies. If the ratio of the target group exceeds the average, it could be an indication that the target company is overvalued and vice versa. However, one should be careful interpreting these results and not drawing conclusions too quickly. One must understand why the numbers are how they are. Often there are hidden reasons e.g., not included qualitative factors in the valuation (BIWS 2019).