Executive Summary

Getting to grips with the basics of financial management is vital if you want to start your own business initiative in the climate and water sectors, it will help you to take better decisions and convince potential investors to invest in your business. This factsheet covers three important methods for keeping your new business’ financial activities in line: the basic accounting methods of profit and loss (P&L), statement and the balance sheet. It will give you an overview of the most important financial terminology and will go on to explain how liquidity planning works, a task that should be carried out on a daily basis.

Basic finance terminology

- Profit

The positive gain you have from running your business after you have deducted your expenses

- Assets

The things you own under your company such as buildings, stock of material, trucks etc.

- Expenses

Anything you will need to pay for in ordert o keep your business running, including electricity, rent, insurance…

- Revenues

The total amount of money you get from selling your products or services

- Capital

The total wealth of your company including the cash, assets and other valuables that your company has

- Loss

The condition in which what you spend is more than what you earn

- Liquidity

How quickly and efficiently a company is able to raise cash, meaning turning assets or investments into cash. No liquidity basically means no cash in the bank.

- Investement costs

These costs tend to take place at the beginning of a business and include anything you need to aquire to set up your business incudung purchase of land, machinery, equipment, or construction costs.

- Operations costs

The costs associated to the operation and maintainance of your business. Remember, that operations are not just about the technical production process, it also includes support activities like marketing & sales, human resources, financial management and other things might eat up a lot of cash

- Gross margin

Gross margin is the total amount of money left in a company after it has paid everting needed to produce and sell its goods. It is the net sales less the cost of goods sold (COGS).

- Fixed Costs

These costs are there regardless oft he production volume and they are always the same. So whether you make a lot of profit or one month and little profit the next, these costs will not alter. Examples are rent, salary, interest payment on loans etc.

Liquidity Planning

Liquidity planning or cash management means ensuring that your project remains solvent at all times (solvency is a company’s ability to meet its obligations and long-term debts). (CREDIT SUISSE 2014).

Liquidity planning can either make or break your business. Just because your business is doing well and you are making a profit doesn’t mean you are keeping your business afloat, if you haven’t planned your liquidity and have no cash in the bank, you are unlikely to meet your business obligations on time. Cash management involves forecasting, collecting, disbursing, investing, and planning for the cash. It is a vital task, as projects can fail due to being insolvent. According to statistics, more projects and start-ups fail due to a lack of cash than due to a lack of profit!

Let’s look into the two main steps of liquidity planning:

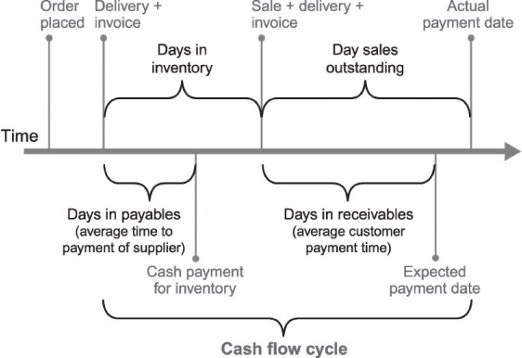

- Cash Flow Cycle

The first thing when preparing your project’s liquidity planning is to understand your project’s cash flow cycle: the time lag between paying suppliers for merchandise or materials and receiving payment from your target groups/end-users for your offered solution or service. The longer your project’s cash flow cycle, the more likely it is that your project will encounter a cash crisis. On a daily basis, you should generate or update a report showing the following aspects of your project: total cash on hand, bank balance, summary of the day’s sales, summary of the day’s cash receipts, summary of the day’s cash disbursements, and a summary of accounts receivable collections (Figure 1).

The next step in your effective liquidity planning is analysing your project’s cash flow cycle, looking for ways to reduce its length. You can achieve this by either reducing the time of your solution in inventory, or by reducing the days in receivables, e.g. by billing your target groups/end-users promptly and offering them discounts for fast payments.

- Preparing a Liquidity Plan

Typically, young professionals starting a business should project a monthly liquidity plan or cash budget to cover at least one year. A liquidity plan is nothing more than a forecast of your project’s cash inflows and outflows for a specific time period. You should keep in mind, that your liquidity plan will never be completely accurate. Cash receipts and cash disbursements are recorded only when the cash transaction is expected to take place.

There are countless variations and formats for preparing your project’s cash budget depending on the pattern of your project’s cash flow. You should divide each one of your monthly columns into two sections — estimated and actual — so you can update each succeeding cash forecast accordingly. There are many templates available to you on the web and found embedded in many spreadsheet calculators such as Microsoft Excel.

There are five basic steps you need to take to complete your project’s cash budget:

- Determining an adequate minimum cash balance. How big should your cash cushion or cash buffer be to cover unexpected costs?

- Forecasting sales. Don’t be excessively optimistic in projecting sales.

- Forecasting cash receipts. Account for the delay between the sale and the actual collection of the proceeds.

- Forecasting cash disbursements. Record them in the month in which they will be paid, not when the obligation is incurred.

- Determining the end-of-month cash balance. The cash on hand, adding total cash receipts and subtracting total cash disbursements. A pattern of cash decreases should alert you that your project is approaching a cash crisis.

Profit and Loss Statement

(Adapted from ZIMMERER et al. (2011) and STEVEDAVIES (2008))

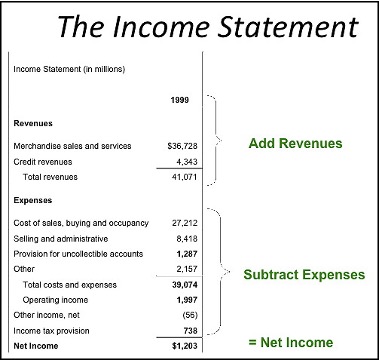

The profit and loss statement (P&L) compares the expenses of your project against its revenue over a certain period of time to show you your project’s net profit (or loss). The P&L is a “moving picture” of a project’s profitability over time. To calculate your net profit or loss, you must record all of the income that flows into your project regardless if it is sale revenues, rent, investments, interest, … etc. and subtract your project’s various expenses such as cost of sales, salary, cost of marketing campaigns and other expenses. Be sure to visibly include the period of time on your income statement! (Figure 2)

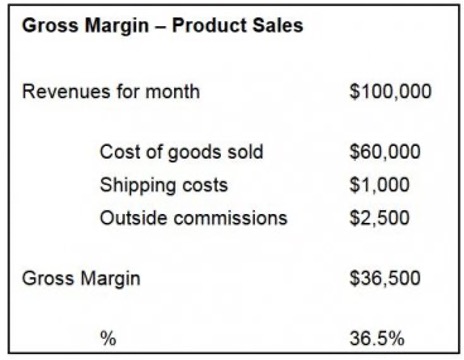

- Gross Margin and Gross Margin Ratio

The gross margin or gross profit is an important indicator in any project. If your project’s gross margin ratio slips too low, it is likely that it will operate at a loss. Many people fail to measure their gross margin/profit accurately, partly because it varies depending on the market (see below).

- Gross Margin Calculations for Product Sales

If your project targets reselling or redistributing products that solve issues in the climate and water sectors as a business model, you can calculate your project’s gross margin easily by taking your revenues and subtracting the costs of producing and selling your goods.

Check out Figure 3 to understand the gross margin and gross margin percentage calculation more concretely:

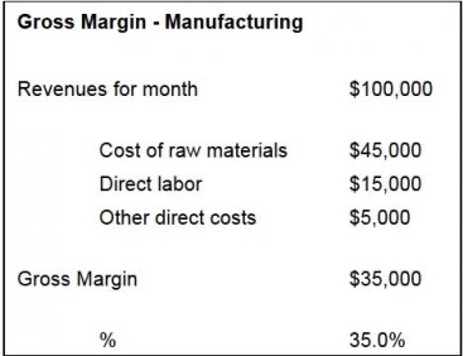

- Gross Margin for Manufacturing

If your project consists of manufacturing innovative products and solutions to solve water and climate-related challenges, you can calculate your project’s Gross Margin by following the same principle explained above, with cost of raw materials replacing the cost of goods sold in the previous example (Figure 4). In addition, you should include your direct labour costs in the equation.

Direct labour costs are all those costs directly associated with the production of the product. If you have employees supporting you in the manufacturing process, you should record their entire cost here regardless of your payment method (whether they are salaried or hourly paid). If you are not involving them in the implementation of your project, then that will start to show up in your calculation of your project gross margin percentage (Figure 4).

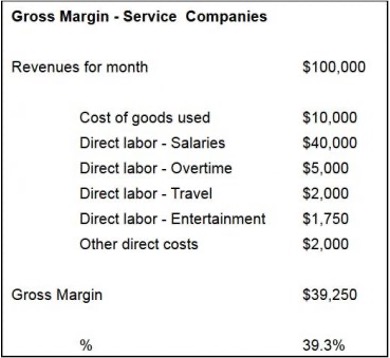

- Gross Margin for Service Providers

If you are developing a project in the water and climate sectors that offers a service calculating your project’s gross margin can be a bit more tricky since it is harder to calculate the cost of providing a service than that of producing a product. The largest expense component in most service-oriented projects is the payroll of the people you hired/partnered with to provide the service.

Take a look at the template (Figure 5) to see what a Gross Margin in a service-oriented project looks like:

Balance Sheet

The balance sheet takes a “snapshot” of your project financial position and provides you with an estimate of its worth on a given date. It has two main components: 1) assets belonging to your project and 2) claims that you and your creditors have against those assets. A balance sheet allows you to plan and make informed decisions.

Generally, every balance sheet is built on the fundamental equation: Assets = Liabilities + your equity. Keep in mind that any changes on either side of the equation affects the other side (hence the name balance sheet).

- Assets

The first, left section of the balance sheet lists all of your project’s assets and shows the total value of everything your project owns. Generally, current assets consist of cash and items that you need to convert into cash within one year or within the normal operating cycle of your project (whichever is longer). Fixed assets are those acquired for long-term use in the project (e.g. of production).

- Liabilities

The right side of the equation shows your project liabilities, and the creditors’ claims against its assets. Generally, current liabilities are those debts that you must pay within one year or within the normal operating cycle of your project, whichever is longer. Long-term liabilities are those that come due after one year (e.g. mortgage).

Managing your project finances might seem overwhelming at first but it is a vital part of developing a successful business and it is something that you naturally become better at overtime. Want to learn more? Have a look at the list of useful resources that we have included below.

Useful resources

Business Builder 2. How to Prepare and Analyze a Balance Sheet

This document helps you to examine the concepts of assets, liabilities and net worth in order to relate them to your business. This edition teaches you how to create a balance sheet.

ZIONS BANK (2005): Business Builder 2. How to Prepare and Analyze a Balance Sheet. In: Zions Business Resource Center: URL [Accessed: 26.04.2021]

Business Builder 3. How to Prepare a Profit and Loss (Income) Statement

This publication informs you about the purpose of a profit and loss statement (P&L), and gives you advice on how to prepare a P&L statement. It also provides a short checklist.

ZIONS BANK (2005): Business Builder 3. How to Prepare a Profit and Loss (Income) Statement. In: Zions Business Resource Center: URL [Accessed: 26.04.2021]

Business Builder 4. How to Prepare a Cash Flow Statement

Before handling a cash budget yourself you should understand the cash flow in your company. This report gives an overview over cash flow and the components in a cash flow statement. Further, it gives you advice on how to prepare a cash flow statement, as well as explaining two methods for constructing the statement. It closes with a chapter on analysing a cash flow statement.

ZIONS BANK (2005): Business Builder 4. How to Prepare a Cash Flow Statement. In: Zions Business Resource Center: URL [Accessed: 26.04.2021]

Business Builder 5. How to Prepare a Cash Budget

This pdf outlines the purpose of a cash budget or liquidity plan, and is a guide on creating and analysing a cash budget yourself. It also contains a checklist for your liquidity plan.

ZIONS BANK (2005): Business Builder 5. How to Prepare a Cash Budget. In: Zions Business Resource Center: URL [Accessed: 26.04.2021]

http://www.bizfilings.com/toolkit//sbg/finance/getting-financing.aspx [Accessed: 26.04.2021]

The Business Owner’s Toolkit is a comprehensive source for business knowledge. In a chapter it covers all the aspects of financing a (prospective) business owner should know. Further chapters of the Toolkit are “Start-Ups”, “Running a Business”, “Marketing”, and “Office & HR”.

Figure 1: Representation of the cash flow cycle

Figure 2: Schematic overview of the income statement or profit and loss statement

Figure 3: An example of a standard gross margin calculation for a company selling products

Figure 4: A gross margin calculation for a manufacturing company. Note that the cost of raw materials is by far the highest

Figure 5: An example of a gross margin calculation for a service company. Note that the material costs are very low

Go to next topic!

3.9 Innovation Strategies

Net Fixed Assets Definition and Examples

Analyse Liquidity

The analysis of your company's current liquidity situation is important for deciding how to invest your available liquidity. This link shows you how to conduct an analysis as part of your financial planning.

CREDIT SUISSE (2014): Analyse Liquidity. Obtain an up-to-date overview of your company’s liquidity situation. Zurich: Credit Suisse AG URL [Accessed: 11.12.2015]Key Performance Indicators

A description of gross margin calculations with examples.

STEVEDAVIES (2015): Key Performance Indicators. Huntington, NY: Steve Davies URL [Accessed: 11.12.2015]Essentials of entrepreneurship and Small Business Management

Business Builder 2. How to Prepare and Analyze a Balance Sheet

This document helps you to examine the concepts of assets, liabilities and net worth in order to relate them to your business. This edition teaches you how to create a balance sheet.

ZIONS BANK (2005): Business Builder 2. How to Prepare and Analyze a Balance Sheet. In: Zions Business Resource Center: URL [Accessed: 11.12.2015]Business Builder 3. How to Prepare a Profit and Loss (Income) Statement

This publication informs you about the purpose of a profit and loss statement (P&L), and gives you advice on how to prepare a P&L statement. It also provides a short checklist.

ZIONS BANK (2005): Business Builder 3. How to Prepare a Profit and Loss (Income) Statement. In: Zions Business Resource Center: URL [Accessed: 11.12.2015]Business Builder 4. How to Prepare a Cash Flow Statement

Before handling a cash budget yourself you should understand the cash flow in your company. This report gives an overview over cash flow and the components in a cash flow statement. Further, it gives you advice on how to prepare a cash flow statement, as well as explaining two methods for constructing the statement. It closes with a chapter on analysing a cash flow statement.

ZIONS BANK (2005): Business Builder 4. How to Prepare a Cash Flow Statement. In: Zions Business Resource Center: URL [Accessed: 11.12.2015]Business Builder 5. How to Prepare a Cash Budget

This pdf outlines the purpose of a cash budget or liquidity plan, and is a guide on creating and analysing a cash budget yourself. It also contains a checklist for your liquidity plan.

ZIONS BANK (2005): Business Builder 5. How to Prepare a Cash Budget. In: Zions Business Resource Center: URL [Accessed: 11.12.2015]http://www.bizfilings.com

The Business Owner’s Toolkit is a comprehensive source for business knowledge. In a chapter it covers all the aspects of financing a (prospective) business owner should know. Further chapters of the Toolkit are “Start-Ups”, “Running a Business”, “Marketing”, and “Office & HR”.