Resumen ejecutivo

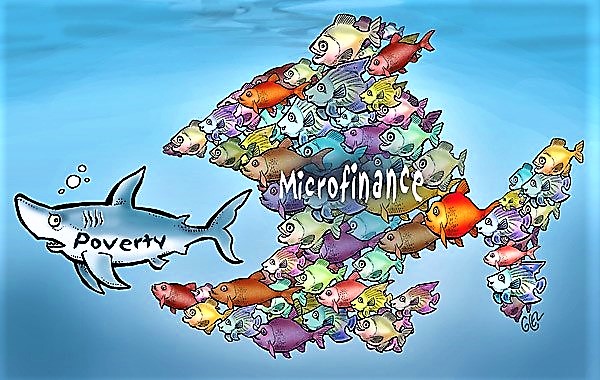

Traditional banks do not usually reach the rural population and are not interested in giving small loans to low-income families. For this reason, microfinance has been recognised as an important instrument to meet the financing needs of the rural poor and low-income population (MEHTA 2008). Microfinance is about giving small loans for different purposes that usually range from 50 to 400 USD (VARLEY 1995). In the sanitation and water sector, microfinance can be used to purchase a pump, build a latrine or a toilet or to pay for the connection to an existing piped water system.

Introduction

Microfinance is a lending mechanism, which is similar to a loan given by a bank, but differs in its nature and size. Microfinance is generally small in volume and responds directly to the specific needs of rural or low-income urban communities (WPP 2010). The term microfinance usually refers to microloans, microcredits or small loans that are given to individuals, households, groups or small business owners (entrepreneurs).

For example, a family or an individual buys a water/sanitation system. Here, the filter, rope pump or latrine can be considered as an investment for which the family or an individual contracts a loan. This becomes attractive for the microfinance institute (MFI), when the client can show that the investment will improve his/her income (e.g. treadle pump to irrigate a vegetable garden) (SINGELING et al. 2009).

Why Microfinance?

On-site water and sanitation investment usually remains a household responsibility with choice about cost and quality limited to market conditions (VARLEY 1995). Therefore, microfinance is a suitable way for those who cannot afford to invest in expensive but higher quality water and sanitation systems.

For instance in Wogodogo, a low-income neighbourhood in Burkina Faso, a savings-microcredit initiative was established for household management of domestic waste and the development of household sanitation facilities. The credit was provided by LAGEMYAM, a women’s association working for improved sanitation. LAGEMYAM agreed to finance the initial 70% required to start up the credit system. The interest rate was set to cover the administrative costs. No securities to back up the loan were required, as the population did not have the resources to meet such requirements (SINGELING et al. 2009).

Sources of Microfinance

There are generally two kinds of sources:

- Formal Sources: microfinance banks, rural banks, NGOs, credit unions and micro loan organisations

- Informal Sources: community-based saving, loan groups and individuals

Types of Microfinance

There are four types of microfinance for water and sanitation:

Formal loans for households: NGOs, micro loan organisations and microfinance banks usually provide these kinds of loans.In this case the borrowers apply for loans and enter into a legal agreement to make repayments according to a schedule. Depending upon the regulations of the governing institution, the borrowers may or may not provide securities (VARLEY 1995).

Targeted loans for households: These kinds of loans are mainly provided by development agencies that aim at improving water and sanitation conditions. They are specifically targeted at households who have poor sanitation facilities. The micro loan provider does not give the loan unless the borrower agrees to use it purposefully and with the quality required by the loan provider. In this case, monitoring is usually done by the loan provider to ensure that the loan has been used purposefully and with the quality agreed upon.

Informal loans: These are provided by community-based saving and loan groups as well as individuals (for example friends and relatives). To be able to get access to these loans membership in the group is a must.

Loans for small businesses: These types of loans are offered mainly to entrepreneurs who engage in the water and sanitation business (see sanitation as a business). It can be either formal or informal depending on the source of finance. The loans are mainly used by the enterprise as working capital or investment allowing it to buy raw material, or allowing it to create a stock of finished products (SINGELING et al. 2009).

Criticism of Microfinance

(Adapted from KARNANI 2011)

Microfinance has grown considerably in the last 30 years and become increasingly commercialised. The volatile combination of profit-seeking companies, minimal competition, and vulnerable, ill-informed, and ill-educated borrowers has opened up dangerous potential for exploiting the poor.For instance, in the Indian state of Andhra Pradesh more than 200 people committed suicide, allegedly because of intimidation by MFIs. Government authorities closed down 50 branches of two major MFIs in 2006 and charged them with exploiting the poor with suspect interest rates and intimidating the borrowers with forced loan recovery practices.

Things to Consider

For getting access to any kind of loan there are terms and conditions under which the loan is given. These terms and conditions include: type of loan, interest rate, period of the loan, securities, currency, methods of repayments, etc. Therefore, it is very important to be aware of all terms and conditions of micro loan providers and only then agree to take the loan. This will help to avoid any future frustrations.

There is no standardised loan specifically for the water and sanitation sector. The requirements for getting a loan differ from country to country and from provider to provider.

There are many possible ways at the international, national and local level to finance water and sanitation services. However, there is no complete database in which they are all presented (SINGELING et al. 2009).

Microfinance Needs Regulation. Stanford Social Innovation Review

Does Microfinance Work?

Assessing Microfinance for Water and Sanitation. Exploring Opportunities for Sustainable Scaling Up. Final Report for the Bill and Melinda Gates Foundation

Smart Finance Solutions. Examples of Innovative Financial Mechanisms for Water and Sanitation

This booklet on Smart Finance Solutions, gives examples of how various existing financial mechanisms and products are being used to finance water and sanitation projects and small local businesses

SINGELING, M. CLAASEN, F CASELLA, D. DAALEN, T. FONSECA, C. (2009): Smart Finance Solutions. Examples of Innovative Financial Mechanisms for Water and Sanitation. Netherlands Water Partnership (NWP) and International Water and Sanitation Centre (IRC) URL [Visita: 21.06.2019]Financial Services and Environmental Health. Household Credit for Water and Sanitation

Guidelines for User Fees and Cost Recovery for Rural, Non-Networked, Water and Sanitation Delivery

Local Financing Mechanisms for Water Supply. Background Report for WELL

This paper shows how local microfinance activities such as revolving funds, community rotating savings and credit associations (ROSCAS) work for improving water and sanitation in Ghana. In addition, other examples of local microfinance mechanisms for water and sanitation from Cambodia, Uganda, Cote d'Ivoire and India are provided.

AGBENORHERI, M. FONESKA, C. (2005): Local Financing Mechanisms for Water Supply. Background Report for WELL. URL [Visita: 23.06.2019]Making the Poor Pay for Public Goods via Microfinance: Economic and Political Pitfalls in the Case of Water and Sanitation, 2011

This paper critically assesses microfinance’s expansion into the provision of public goods. It focuses on the problem of public goods and collective action and refers to the specific example of water and sanitation. The microfinancing of water and sanitation is a private business model that requires households to recognise, internalise and capitalise the benefits from improved water and sanitation.

MADER, P. (2011): Making the Poor Pay for Public Goods via Microfinance: Economic and Political Pitfalls in the Case of Water and Sanitation, 2011. URL [Visita: 28.10.2011]Credit for Water and Sanitation Improvements. A Case Study of Women's Self-Help Groups in Tamil Nadu, India

In this case study we examine a program carried out in and around the city of Tiruchirappalli (Trichy), Tamil Nadu, India. This WaterPartners microfinance program was implemented by our partner organization, Gramalaya, a water and sanitation focused non-governmental organization (NGO) based in Trichy. The program involved the construction of water and sanitation facilities by mobilizing a network of women's self-help groups (SHGs) to utilize a revolving loan fund.

WATER PARTNERS INTERNATIONAL (n.y): Credit for Water and Sanitation Improvements. A Case Study of Women's Self-Help Groups in Tamil Nadu, India. [Accessed: 24.08.2011] PDFMicrofinance for Water and Sanitation: A Case Study from Tiruchirappali, India

This paper looks at the development of a water and sanitation loan fund deployed through a network of women’s selfhelp groups in Southern India. The success of the loan fund reduced barriers to credit from formal lending institutions and increased investment in water and sanitation facilities. Results from this case study indicate that microfinance principles can be successfully applied to the water and sanitation sector. The objectives of this case study are to summarize what is known about this loan program and explore the possibilities and limitations of this new financing model for the water and sanitation sector.

BARENBERG, A. (2009): Microfinance for Water and Sanitation: A Case Study from Tiruchirappali, India. URL [Visita: 24.08.2011]Evaluating the Potential of Microfinance for Sanitation in India

This case study investigates how household financing for sanitation can be mobilised via microfinance institutions and commercial banks in order to accelerate sustainable access to sanitation facilities and/or services.

TREMOLET, S. KUMAR, T.V.S.R. (2013): Evaluating the Potential of Microfinance for Sanitation in India. London: Sanitation and Hygiene Applied Research for Equity (SHARE) URL [Visita: 23.06.2019]Understanding Willingness to Pay for Sanitary Latrines in Cambodia

Given the low willingness to pay for latrines with cash, efforts to sell latrines at market price without any financing mechanism will lead to continued low penetration. The major implication of this study is that offering microfinance loans for latrines will dramatically increase uptake of latrines, while also making distribution significantly cheaper per latrine sold.

SHAH, N.B. SHIRRELL, S. FRAKER, A. WANG, P. WANG, E. (2013): Understanding Willingness to Pay for Sanitary Latrines in Cambodia. Findings from Four Field Experiments of iDE Cambodia's Sanitation Marketing Program. Denver: iDE URL [Visita: 23.06.2019]Expanding the Frontiers of Microfinance in the Service of the Poor

Microfinance application in water and sanitation is a burgeoning concept. This paper, which is based on a case study in Ghana, provides a clear case of extending microfinance to water and sanitation businesses.

AFRANE, S.K. ; ADJEI-POKU, B. (2013): Expanding the Frontiers of Microfinance in the Service of the Poor. Entradas: International Journal of Academic Research in Business and Social Sciences: Volume 3 , 129-141. URL [Visita: 23.06.2019]The Use of Traditional Microfinance Method as an Innovative Approach to the Development of Obizi Regional Water Supply Scheme in Aguata, Nigeria

The aim of this study was to assess the use of traditional microfinance methods as an innovative approach to the development of Obizi Regional Water Supply Scheme in Aguata, Nigeria.

EZENWAJI, E.E. ; ENETE, I.C. (2013): The Use of Traditional Microfinance Method as an Innovative Approach to the Development of Obizi Regional Water Supply Scheme in Aguata, Nigeria. Entradas: Hydrology: Volume 1 , 18-25. URL [Visita: 23.06.2019]IRC WASH Library - Search

The IRC WASH Library contains different studies on microfinance in water and sanitation in different parts of the world.

The Global Development Research Center (GDRC)

The Global Development Research Centre is an online library that contains different topics on microcredit and microfinance. Topics include microcredit lending models, improving credit access for women, microfinance for microenterprises, etc.